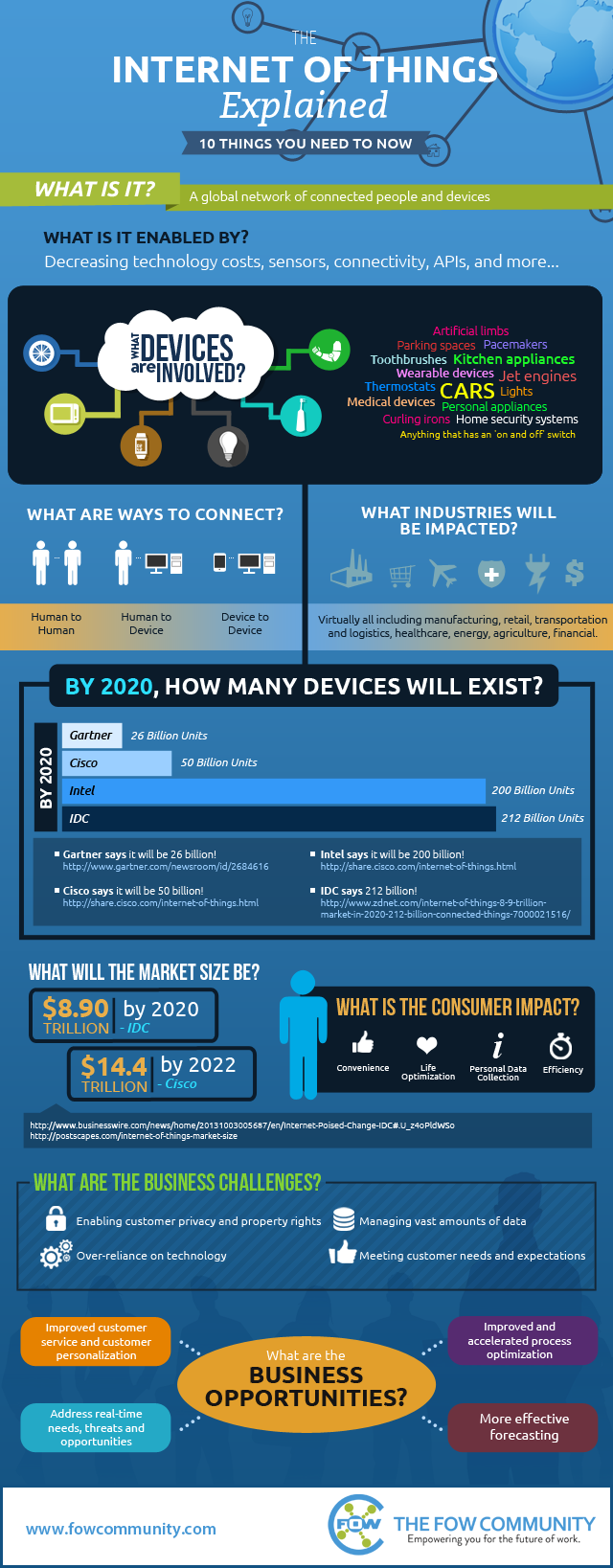

Profiling 600 companies and including 553 supporting tables and figures, recent reports into the M2M Internet of Things and Wearable Technology ecosystems forecast opportunities, challenges, strategies, and industry verticals for the sectors from 2015 to 2030. With many service providers looking for new ways to fit wearable technology with their M2M offerings in order to route the masses of data being collected, IoT service providers may receive service revenues of up to $231 billion by the end of 2020, suggesting a CAGR of 40% between 2015 and 2020.

With consumer voice and data service revenues reaching a saturation point, mobile operators are looking for new avenues to increase revenue growth, and providing connectivity for M2M (Machine to Machine) devices could be the next big opportunity.

(Infographic Source: The Fow Community)

Devices such as connected cars, smart meters, and healthcare monitors are becoming more commonplace, encouraging growth in various associated industries, and M2M connectivity could provide multi-billion dollar revenue options for MVNOs, mobile operators, and service aggregators attempting to address these needs. Enabling network connectivity between physical objects, M2M boosts the IoT vision of a global connected network of equipment, sensors, smart devices, appliances and applications able to communicate in real time, and furthermore allows for the monetization of wearable technology.

This year, 72.5 million connected wearables were shipped, almost triple as many as shipped in 2014. With a compounded annual growth rate of 25.8%, total shipments of smart glasses, smart watches, activity and fitness trackers, people and safety monitoring devices, medical devices, etcetera, it’s forecast that this figure will reach 228.3 million units shipped in 2020. It’s expected that Bluetooth will continue to be the primary connectivity option in the future, and forecasts suggest that 17.8 million of the wearables sold in 2020 will incorporate embedded cellular connectivity – specifically covering the smart watch and people monitoring and safety categories.

With Apple quickly becoming the leading smartwatch vendor in 2015, competition is hitting back hard, providing attractive Android Wear devices from vendors such as LG, Motorola, Asus, and Huawei, while vendors such as Samsung and Pebble explore alternate platforms. By the end of 2015, it’s expected that 19.5 million smart watches will have shipped, a 353% year-on-year increase. Additionally noted by Johan Svanberg, Senior Analyst for Berg Insight, “This market development has not gone unnoticed by the traditional watch industry and several vendors including Fossil and TAG Heuer have presented smart watches of their own.”

Though fitness and activity trackers are currently the largest device category, in the next five years, improved devices available in different price segments will encourage adoption, and smart watches are predicted to become the primary category. New form factors and decreasing costs are, however, likely to enable dedicated activity and fitness trackers to reach 71 million shipments in 2020.

Already common in the medical and people monitoring sectors, connected wearables such as ECG monitors, cardiac rhythm management devices, mobile Personal Emergency Response Systems (mPERS), and wearable computers are likely to infiltrate new markets, thanks in part to low power wireless connectivity, miniaturized electronics, and cloud services providing a wider range of connected wearables such as notification rings, gesture wristbands, smart gloves, and smart motorcycle helmets. And though smart glasses shipments have been fairly small to date, promising use cases in both niche consumer segments and professional markets suggest smart glasses will become a considerable connected wearable device category by 2020.

By Jennifer Klostermann