The most cautious person in any organization is likely to be the CFO. After all, they’re the person who gets paid to ensure the company’s finances are protected from unwarranted risk. However, even the most risk-averse of CFOs are beginning to warm to the possibility of moving their firms’ financial management systems to the cloud.

One thing you can say about the adoption of cloud services by businesses: It’s unconventional. After all, the first people in the organization to use the cloud in their work were usually renegades who did so without the official sanction of their company’s IT department. Out of this “shadow IT” grew the topsy-turvy, bottom-up evolution of cloud migration in companies of all sizes.

You might say that the cart’s before the horse, or the tail’s wagging the dog, but however you slice it, cloud services are proving their worth to businesses in many diverse ways. Jeffrey Kaplan writes in an October 31, 2016, article on Datamation that the typical cloud-adoption pattern is for the sales and marketing departments to lead the way, initially in an ad-hoc manner but ultimately with the blessing of the IT department and the CFO.

Kaplan cites a recent CFO Signals survey by Deloitte that found nearly 80 percent of companies in North America use some cloud services, yet fewer than half have implemented any cloud-based finance and accounting analytics. The slow adoption rate of cloud-based financial solutions is due as much to lingering concerns about security and integration as it is to the generally conservative nature of the CFO role, according to Kaplan.

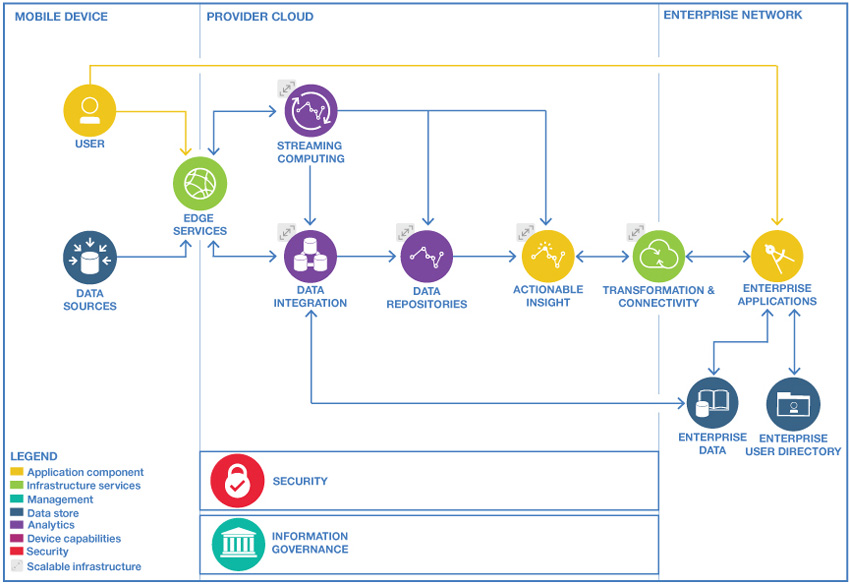

The 30,000-foot view of data analytics in the from the enterprise perspective extends the model from mobile users and data sources to enterprise data and user directories. Source: IBM

A potential source of motivation for companies evaluating cloud financial services is the need to respond to new guidelines issued by the Financial Accounting Standards Board, whose ASC 606 standard requires that firms identify performance obligations in all customer contracts and base revenue recognition on a contract basis rather than on a transaction basis. The new rules don’t take effect until late 2017, but it will take time for companies to make the necessary changes to their financial accounting procedures.

By slowly transitioning to cloud based financial management, CFOs hope to avoid the glitches that arose with the first round of cloud-migration projects. According to Mark Melin in a November 1, 2016, article on ValueWalk, a study by SunGuard found that 73 percent of companies spent more on their move to the cloud than they anticipated. In addition, 66 percent of the organizations surveyed eventually moved some of their early cloud applications back to their in-house infrastructure.

The switch from in-house financial management to its counterpart in the cloud is more difficult because the old and new have very different foundations. Traditional finance operations run on an internal grid designed from the ground up for risk calculations, portfolio pricing, liquidity analysis, and other high-performance workloads. The cloud, on the other hand, is optimized for scalability and agility, which introduces a high level of latency and scheduling that can spell trouble for financial calculations.

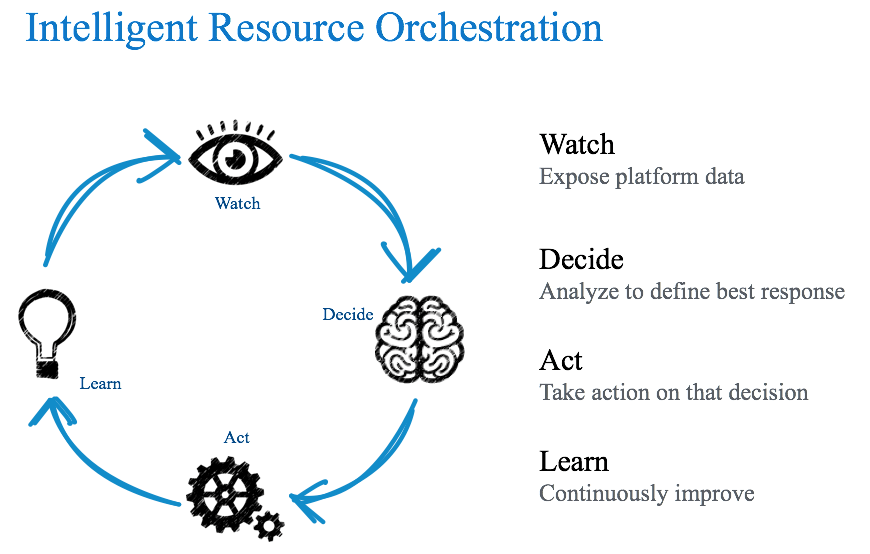

The problem of remote analytics may be solved by advances in telemetry: the collection, measurement, and monitoring of data from a remote source. In a November 7, 2016, article in Data Center Journal, Jonathan Donaldson describes an approach called Intelligent Resource Orchestration (IRO) that extends telemetry by enabling analytics in software-defined infrastructures. IRO relies on sophisticated pattern matching to automate much of the decision making, which reduces human interaction. For IRO to be successful, it must be able to discern which decisions can be automated, and which need to be made by humans.

The IRO model consists of four components that interact in continual loops:

In the IRO model, four modules continually interact to reduce the amount of human intervention required in cloud-based analytics. Source: Jonathan Donaldson, via Data Center Journal

According to Donaldson, IRO holds promise for addressing the performance needs of any “latency-sensitive” applications, including financial services and content delivery networks.

Research firm Accenture estimates that by 2020, finance productivity will increase by a factor of 2 to 3 times, while financial-management costs will decline by 40 percent over the same period. The key to this productivity boost is automated decision making. A new approach to automated financial analytics based on a non-stop loop is continuous accounting, which Information Age’s Nick Ismael explains in an October 27, 2016, article.

As Ismael points out, only the agility and flexibility of cloud-based services make it possible to replace manual accounting methods, freeing financial analysts to focus on fraud detection, compliance, and other strategic matters rather than spreadsheet updates and weekly reports. These are the same reasons companies of all sizes are turning increasingly to services in order to automate uptime monitoring of IT systems of all types: databases, app servers, web servers, and message queues, all viewed in a single app.

By Brian Wheeler