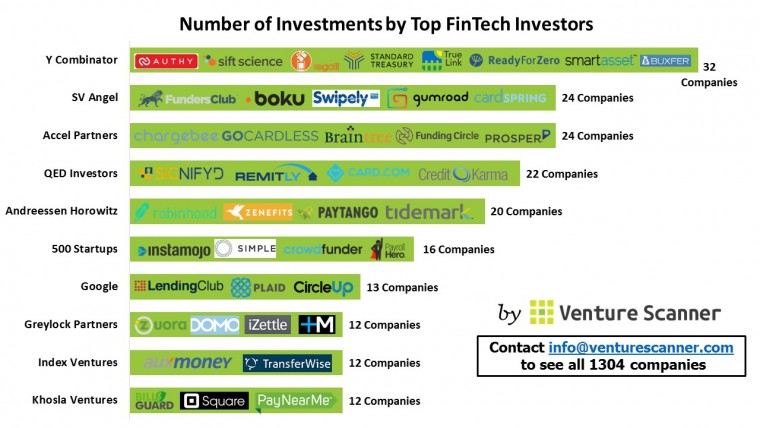

Fintech investment has been seeing consistent growth in 2015, with some large moves being made this year. The infographic (Courtesy of Venturescanner) below shows the top Fintech investors and the amount of companies they’re currently funding:

Just this week, a financial data startup known as Orchard Platform raised $30 million in their Series B funding round. With such a fast-growing market, investors are clawing at the chance to be apart of a potentially huge new wave of financial technology.

“There’s definitely a lot of investor interest in this space. Overall it’s another validation,” Matt Burton, co-founder and chief Executive officer of Orchard said on Wednesday.

The financial online marketplace has been made extremely popular with the success of lending tech firms Lending Club and Prosper. While Fintech firms aren’t aiming to render traditional banks as obsolete, they’re making strides towards alternative way of financing. When you’re applying for a loan from Lending Club, institutional investors and hedge funding, the primary buyer of the loans that Lending Club is creating provide the money. Orchard is responsible for the creation of the technology that many of these firms are using.

Other startups like Sift Science (Y Combinator’s most recent investment) creates the technology used to prevent fraud for digital businesses with the use of big data, real-time Machine Learning, and human intelligence. Sift Science received $18 million last year in their series B funding, validating that the continued advancement of the different niches of Fintech will be sure to receive investment as the year continues. It’s a new generation of an industry that needs to make finance safer, and Goldman Sach’s estimates the total value of the industry to be $4.7 trillion.

By Keith Baird