With technology permeating all industries, few of us would feel confident utilizing financial products or services that aren’t thoroughly tech-integrated, and yet the realm of fintech is still observed warily by many. Though fintech indeed incorporates many of the cutting-edge innovations which bring finance and technology together, sometimes in scenarios considered risky, or at the very least enigmatic, much of today’s fintech provides the backbone for our financial institutions and ensures we’re able to manage our business and personal finances both conveniently and securely. It’s difficult to imagine a world without internet banking, mobile banking, and even online payment systems such as PayPal, but even more innate to our current financial systems are technologies which prevent check fraud, make possible a cashless society, enable (wisely or not) the proliferation of credit cards and short term loans, and put investment opportunities directly into the hands of both small and large-scale investors. Perhaps some of the suspicions can be put down to a lack of education in the fintech environment, a condition the fintech and educational industries are working hard to rectify.

Though financial education programs are widely evident globally, many of them have retained much of their traditional compositions for decades with little thought to the technological advances impacting the industry. However, many prominent schools, colleges, and universities are moving towards curriculums with greater technological training, and finance courses are being revised to meet today’s standards. Some notable fintech courses can even be accessed online, including MIT’s Future Commerce program which deals with fintech trends, and Columbia FinTech opening up study in various fintech sectors such as digital investing, and entrepreneurship and innovation in financial services.

But such education isn’t available only for those utilizing distance learning programs; NYU Stern already offers a fintech specialization in their MBA curriculum, dealing with an extensive range of fintech from digital currencies, blockchains, and the financial services industry to risk management for fintech to robo-advisors and systematic trading. And outside of the US, the Scotland-based University of Strathclyde has just announced their own master’s program in fintech, the first such course in the UK, which will cover areas such as financial programming and analytics to improve financial security and transacting within the technological realm.

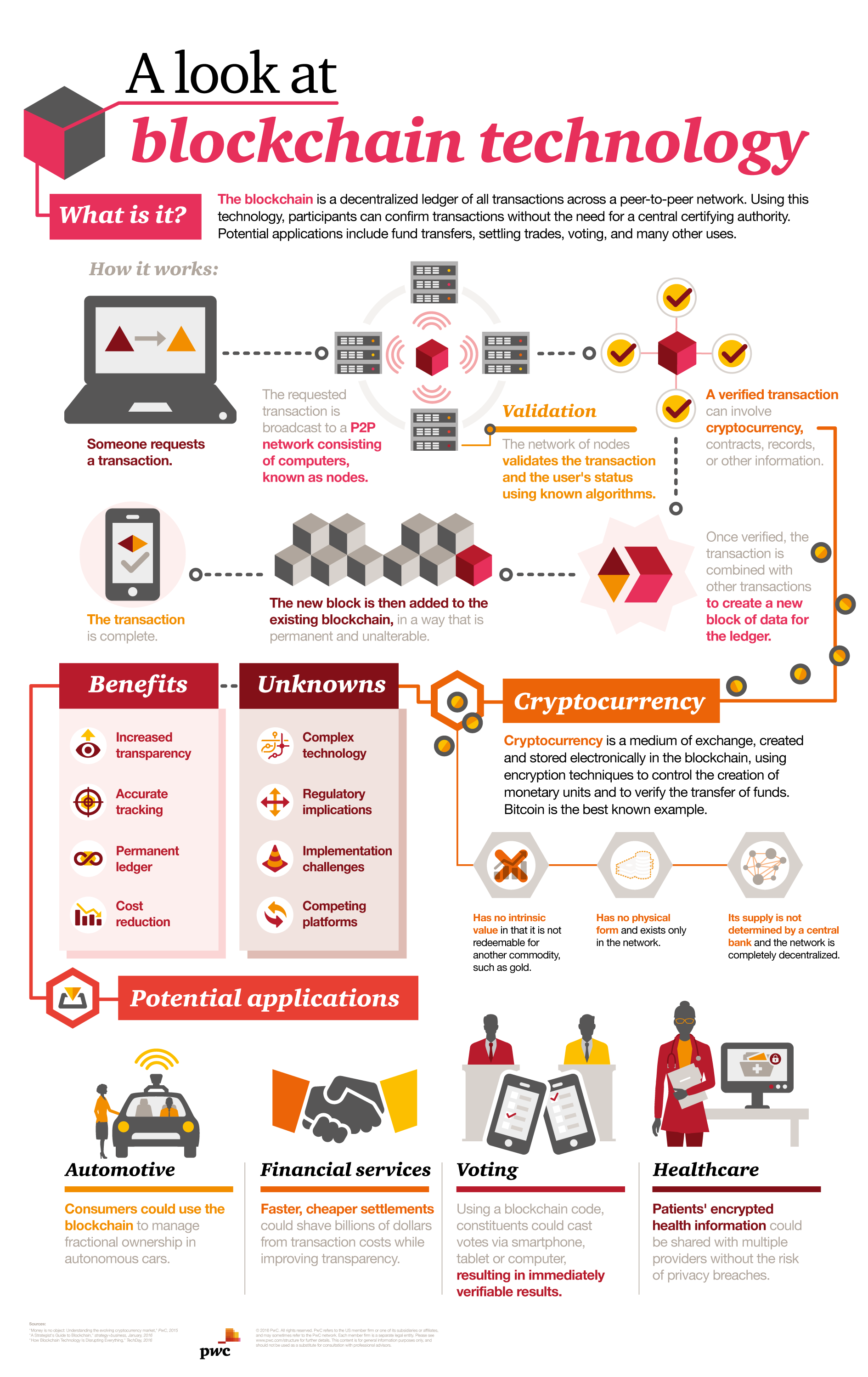

(Infographic source: PWC)

An ingenious, though little understood, financial technology, blockchain allows the distribution of digital information while securing it from replication. It was originally devised for Bitcoin, one of the most prolific digital currencies, but today its potential uses are far wider. Say authors Don and Alex Tapscott, Blockchain Revolution, “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.” Such technology is quite obviously extremely valuable, but because it’s little understood it’s no wonder many of us shy away from the concept. Gladly, educational institutions are incorporating blockchain tuition into their programs, with one online university even named for the technology, Blockchain University, promising hands-on public and private training for startups and corporates alike and encouraging the development of blockchain advances. Online courses from FinTech School, Open University, and Brandeis University, to name a few, also cover aspects of blockchain, along with courses from institutions such as New York University, Duke University, and Canada’s McGill University.

Fintech education, however, is something available only to those participating in formal education; as with most technologies, those wishing to advance their understanding have a wealth of resources at their fingertips thanks to a global community of experts ready to share their own learnings and experiences. And so, whether striving for an expert grasp or merely angling for a stouter layman comprehension, there’s no longer any excuse for any of us to fear or shy away from fintech and its many potentials. It’s time we brushed up on this important technology, ensuring a safer and more beneficial financial landscape for us all.

By Jennifer Klostermann