Clutch, who is a leading IT ratings and review firm in the B2B space, held a survey to find out which of the various large cloud providers that companies prefer. The survey found that larger enterprises prefer to use Microsoft Azure, while SMBs (small-to-medium businesses), strongly preferred the Google Cloud Platform. The purpose of this survey and study was to learn more about these cloud providers and the companies who use and prefer them.

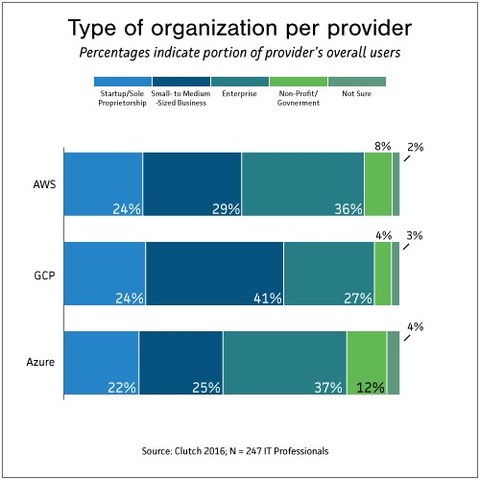

Overall, most businesses used Google Cloud Platform at 35%. Right on its tail, 34% of people reported using Amazon Web Services and 31% said they use Microsoft Azure. While the numbers are fairly close, the differences begin to arise when we look at just who is using each of these services. Nearly 40% of those who use Azure are enterprises with considerably lower numbers for SMBs. On the other hand, 41% of Google Cloud Platform users are identified as the SMBs market.

So why is this?

A couple of industry experts have weighed in on the results. Nicholas Martin, the Principal Applications Development Consultant at Cardinal Solutions, said that “It goes back to trust and familiarity issues”. He also added: “Windows Server and other Microsoft technologies are prevalent in the enterprise world. Azure provides the consistency required by developers and IT staff to tightly integrate with the tools that Microsoft-leaning organizations are familiar with.“

Meanwhile, Dave Hickman, Vice President of Global Delivery at Menlo Technologies, an IT services company, said that “small businesses tend to lean more on pricing than security or toolsets.” Since the Google Cloud Platform is a cheaper option, that is certainly a good enough reason why more SMBs are gravitating towards it.

The survey also asks companies why they decided to go with their chosen cloud provider and many decisions were based on the selection of tools and features offered by their provider, brand familiarity, security, industry fit and a the reputation of the provider.

You can review the clutch survey with infographic on their website.

By Kale Havervold