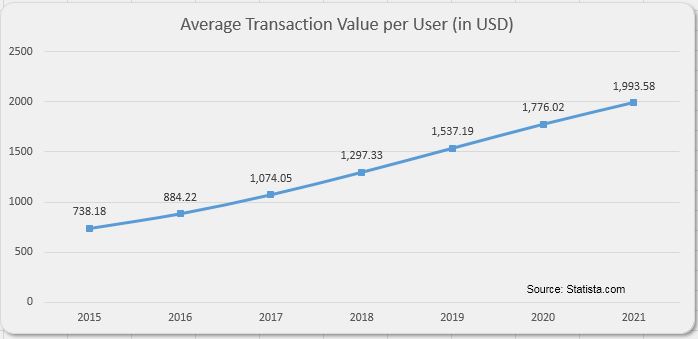

FinTech market transaction value is set to grow 20 percent a year to $7 trillion in 2021. This year will see $3.3 trillion transacted. Digital payments, the largest segment, will be worth $2,7 trillion. Not surprising, then, that many startups are gearing up to poach business from the traditional financial industry. The route they take is via the cloud.

Cloud infrastructures like AWS allow FinTech startups to build up services rapidly and run them at a fraction of the cost of constructing and running traditional infrastructure. Moreover, businesses can easily tailor services to customer needs and market movements by Scaling them up and down relatively painlessly.

Services like investment tools featuring extensive big data analytics can take advantage of powerful multicore virtual machines crunching numbers on demand in the cloud. Doing this in house calls for expensive hardware whose utilization and hence repayment would be problematic.

(Source: Statista)

Many traditional banks saw reputations plunge after the 2008 crisis and controversial practices like the recent Wells Fargo one. This boosted trust in alternative financial services, drawing more venture financing into cloud based financial startups. Fortune sees venture investment in the sector reaching $8 billion by 2018, while global accountants KPMG estimate that VC backed FinTech company funding hit a record of $13.8 billion in financial 2015/16.

Most FinTech startups are launched by experts from traditional financial institutions and plug the consumer trust gap by offering cloud services appealing to a new generation of customer. Legacy IT systems, practices, and restrictions give way to more user friendly and scalable services one can use on the go.

Traditional banks cannot continue monopolizing the entire spectrum of financial services. Small startups disrupt the industry by ‘deploying online platforms, working with small capital bases and making strategic use of data to acquire customers and drive revenue at a fast pace,’ according to a World Economic Forum report.

A financial services company running its entire operation from the cloud enjoys marked advantages over traditional competitors. It has no infrastructure or hardware to manage and may even get rid of PCs, as several FinTech startups already have. All they need to access web applications and other cloud tools are devices like Chromebooks, with core company services running entirely in the cloud. The cost benefits are clear.

This cloud approach allows FinTech startups to innovate much faster than peers relying on internal infrastructure and hardware that may restrict processes, procedures, or even business practices. But moving all into the cloud also has downsides. CRM, customer leads, and many other critical items are in the cloud; if one goes down for whatever reason, so does business operation.

Yet, a cloud based financial services startup frees internal resources for research and development and improving core services (usually also entirely in the cloud). This makes them far more flexible and broadens their service ranges compared to traditional financial service outfits.

All in all, FinTech is set to move its financial services infrastructure increasingly into the cloud. Growing cloud based services will offer innovative financial solutions to customers more willing to use cloud payment and transaction channels.

By Kiril V. Kirilov