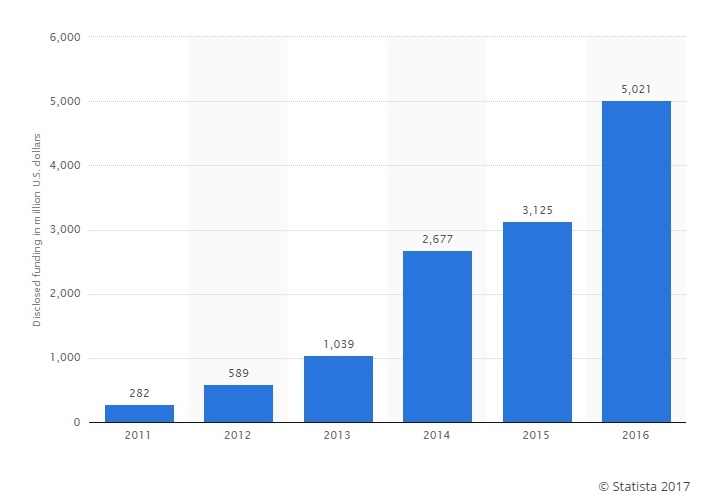

AI startups enjoy unprecedented interest from venture capital investors and large corporations eager to acquire advanced technology that gives competitive edge. More than 550 AI startups managed to raise $5 billion in funding in 2016 that is all time record. Funding and deals involving AI startups are on the rise since 2012 and non-US companies are rapidly chasing their American competitors. In 2012, non-US deals with AI startups stood at 21 percent of all deals while in 2016 the percentage rose to nearly 40 percent.

We see 60-percent rise of investments in AI startups with a good number of deals exceeding $100 million during the last year. For example, Volkswagen invested $300 million in Israel-based ride-hailing app Gett. The company is developing AI algorithms that provide assistance for on-demand car deployment and works on algorithms used in operation of autonomous vehicles. Volkswagen announced that the goal of the funding is to develop predictive algorithms for use in on-demand autonomous cars.

With 2628 artificial intelligence startups listed on AngelList alone, VC investors and corporations have plenty of choices in any industry vertical. For example, VC investors Data Collective have funded more than 20 AI startups in the past five years with other funds like Khosla Ventures and Intel Capital backing more than 15 each during the same period.

Source: Statista – Disclosed funding for artificial intelligence (AI) startups worldwide from 2011 to 2016 (in million U.S. dollars)

In the past few years we are witnessing a wave of acquisitions of startups involved in deep learning technologies and large corporations like Google, Facebook, Microsoft, Salesforce, Twitter, and Uber all acquired a startup or two working in this field. On the other hand, it seems there is oversupply of apps and platforms in this sphere, which might result in less acquisition deals during the next few years. The focus will shift to technologies like neural networks and cognitive computing. Another possible reason for an eventual slowdown on the market for AI startups is that according to many analysts they tend to focus on the technology instead on the customer needs.

In fact, low level task based AI is being commoditized very rapidly. Hence, for the AI startups to enjoy more funding and M&A deals in the coming years they have to shift their focus toward solving of full stack problems of a higher level. We already have a good number of low-level AI services but this market is getting more and more saturated on a daily basis.

A vertical AI startup, for example, solves full-stack problems within an industry. However, this requires unique data and deep knowledge of the subject to deliver a product, which is using AI to deliver its core value proposition. The problem is that people who are knowledgeable but lack subject matter expertise and business skills start most of the AI startups. Hence, we get low-level service that does not meet any real need of customers or a particular industry.

AI startups that want to get funding or seek an M&A exit face two other challenges as well. First, a limited bunch of people starts a good number of all AI startups. Those include both tech geeks and angel or VC investors. Such a scenario does not help diversification and further development of technologies that solve real problems. The second one is arising from the lack of real understanding what AI is and what these technologies should be used for. As Marco Casalaina, VP of product management at Salesforce Einstein, said jokingly at the recent Topbots conference in San Francisco: “Enterprise users don’t know the difference between algorithms and logarithms.”

The future lies with AI startups that solve high-level domain problems and use proprietary data and Machine Learning models to provide a viable solution.

By Kiril Kirilov