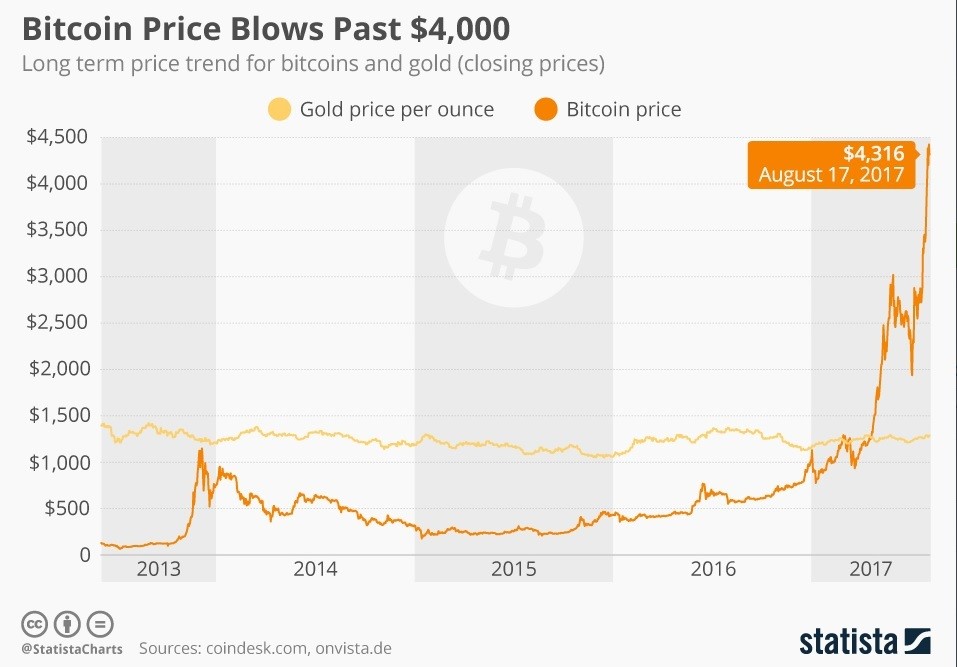

Bitcoin, the most popular virtual currency, hit a record high of over $4,000 per bitcoin. The virtual currency exchange rate stood at “just” $580 in mid-2016 growing impressive 300-fold between 2012 and 2017.

Those inexperienced in cryptocurrencies have a hard time understanding how the value of a virtual currency can raise 300-fold in five years. Many market experts also cite unconvincing reasons why the bitcoin managed to grow from $580 to $4,000 in a single year.

(Image source: Statista)

The single most important driver for the recent surge of the Bitcoin is a decision to process part of each bitcoin transaction outside the Bitcoin block-chain. The decision was made after a long debate how to adopt new policies that will remove the current policy of limiting the size of blocks processed on the Bitcoin block-chain. By adopting the so called segregated witness upgrade of the Bitcoin network, more transactions can move through the block-chain in a single block. This eliminates bottlenecks and makes the virtual currency a more viable one.

Another factor to consider is the adoption of a spin off currency under the name of Bitcoin Cash on August 1. This is actually a split of the Bitcoin network which, however, did not result in any market interruptions. It also did not erode the confidence in the Bitcoin as a whole.

Since the adoption of Bitcoin Cash, the Bitcoin added 50 percent to its value, highlighting the overall confidence in the virtual currency.

It looks like the emergence of numerous cryptocurrencies through initial coin offerings (ICO) does not hurt the Bitcoin, too. A good number of those new cryptocurrencies place their ICOs using Bitcoin as a currency, not traditional currencies like US dollars or another national currency. For its part, the growing demand from investors who need Bitcoins to purchase new exotic currencies is raising the value of the Bitcoin further.

According to reports by financial advisors like Fundstrat Global Advisors, we can witness the Bitcoin hitting the $6,000 mark by mid-2018. It looks like a reasonable estimate if adoption of new regulations do not harm the virtual currency during this period.

The most optimistic estimates are for the Bitcoin skyrocketing to $25,000 by 2022. Growing five-fold within five years and then rising its value further five times during the next five years is something barely experienced in traditional economies where transactions are made in national currencies. That is one of the reasons other analysts suggest Bitcoin and competitors like Ethereum will ruin your investment in the long run.

Cryptocurrencies, however, are booming and demand for Bitcoins is strong which in fact can fuel such uninterrupted high-rate growth for over a decade. If the Bitcoin network is showing steady growth, it will result in surge of the currency’s value as well.

The Bitcoin and all other cryptocurrencies may be a bubble right now, resembling a few past Silicon Valley bubbles. The Bitcoin currency is entering new markets rapidly but one should first look at the fundamentals before going bullish into the cryptocurrency market.

By Kiril V.Kirilov