Artificial intelligence and machine learning are changing the way investors make decisions both at corporate and individual level. Institutional investors are using computing machines to make smarter investment decisions for years. Proliferation of predictive analytics, machine learning, and AI tech, however, make it possible for individual investors to benefit from enterprise-level solutions. Which in turn reshapes the world of financial markets, as we know it.

Robo-advisors, for Instance, are forecast to manage assets worth over $250 billion by 2020. This is the single most popular AI solution available to individual investors willing to invest on the financial markets. Robo-advisors can make passive investment decisions based on a set of rules but the progress in the field of AI and Machine Learning turns them into active platforms that are able to invest in accordance with experience and market patterns.

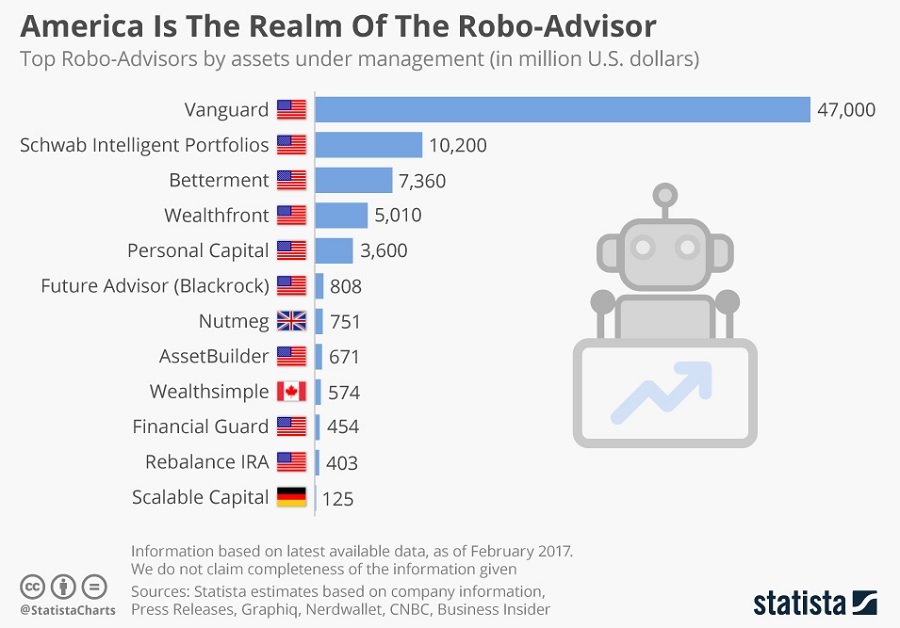

(Image Source: Statista)

Machine learning algorithms already power every single investing platform used by an institutional investor. Deep learning is also becoming widespread across the investing world, allowing fund managers and large investors to benefit from pattern recognition. In result, AI algorithms that are able to recognize previously unknown patterns on the financial markets are replacing traditional technical analysis.

Specific algorithms now track social media and spot messages revealing the overall market sentiment or investors’ expectations about the performance of a specific financial asset. This is a promising technology that is not actually new – market rumors have influenced the financial market for centuries. What is new is that machine learning and AI is more accurate in following trends in the market sentiment and can harness the power of Big Data to analyse investors’ mood at scale.

Speaking of Big Data you should be aware that no one could really cope with the amounts of data available on today’s financial markets. Thousands of large institutional investors are intertwined with millions of small and individual traders in networks where terabytes of data are exchanged on a daily basis. So you need algorithms i.e. AI that can deal with Big Data, processing and analyzing data which contain market patters unrecognizable by a human or traditional computing, machines.

Advancements in Big Data and machine learning algorithms give birth to a new sort of investors, the so-called “quant investors”. They actively look for the biggest available data sets and perform analysis that reveal trading signals which are unavailable to traders without access to cutting edge predictive analytics. The platforms they use also incorporate speech and image recognition capabilities while borrow form these technologies to conduct a very sophisticated market analysis.

Vast amounts of unstructured data are out there for anyone possessing the required tech to grab these data and find patterns mostly unavailable to the average investor. You need enormous computing power and quite sophisticated algorithms to deal with unstructured data but all the required technology is already in place. So quant investors are doing just that using AI and machine learning to beat the market.

Current investing models used by quant investors and their more conservative peers are far from perfect, though. The very application of AI and machine learning in the financial markets creates new patterns and obscures the investing models known to investors. The strange mix of algorithmic trading and human-made decisions opens the gates for both unexplored investment opportunities and errors that could potentially lead to massive losses. A very reliable AI investing algorithm would face other similar algorithms and should incorporate capabilities far beyond the limited world of pure stock or currency trading. As deep learning tech grows, investors should pursue development of AI investing platforms able to cope with the world in its entirety if they are to replace humans as investing gurus.

By Kiril V. Kirilov