The global electric vehicle market is projected to reach $802.81 billion by 2027, registering a CAGR of 22.6%.1 The highest revenue contributor was Asia-Pacific, which is estimated to reach $357.81 billion by 2027, with a CAGR of 20.1%.1 North America is estimated to reach $194.20 billion by 2027, at a significant CAGR of 27.5%. Asia-Pacific and Europe collectively accounted for around 74.8% share, with the former constituting around 52.3% share. North America and Europe are expected to witness considerable CAGRs of 27.5% and 25.3%, respectively, during the forecast period. The cumulative share of these two segments is anticipated to reach 51.0% by 2027.

Globally, 2.5% of new cars sold today are Electric Vehicles (EV). EV deployment has been growing rapidly over the past ten years. By 2022, electric vehicles would account for 35% of all new vehicle sales, and they will cost the same as their international combustion counterparts.

In the United States, Electric vehicles are projected to account for 7.6 percent of the market in 2026, according to Statista.

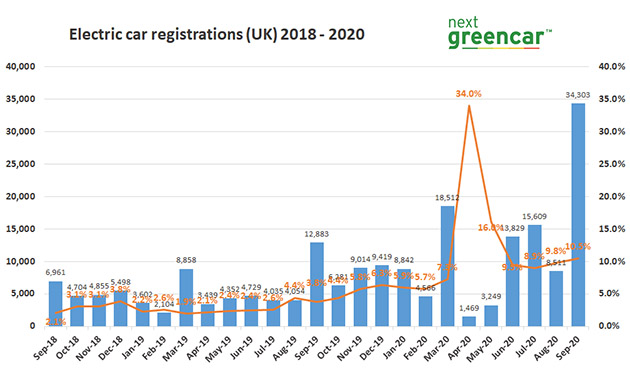

At the end of September, 2020, there were 164,100 pure-electric cars on UK roads. Also, there were 373,600 plug-in models including plug-in hybrids (PHEVs).

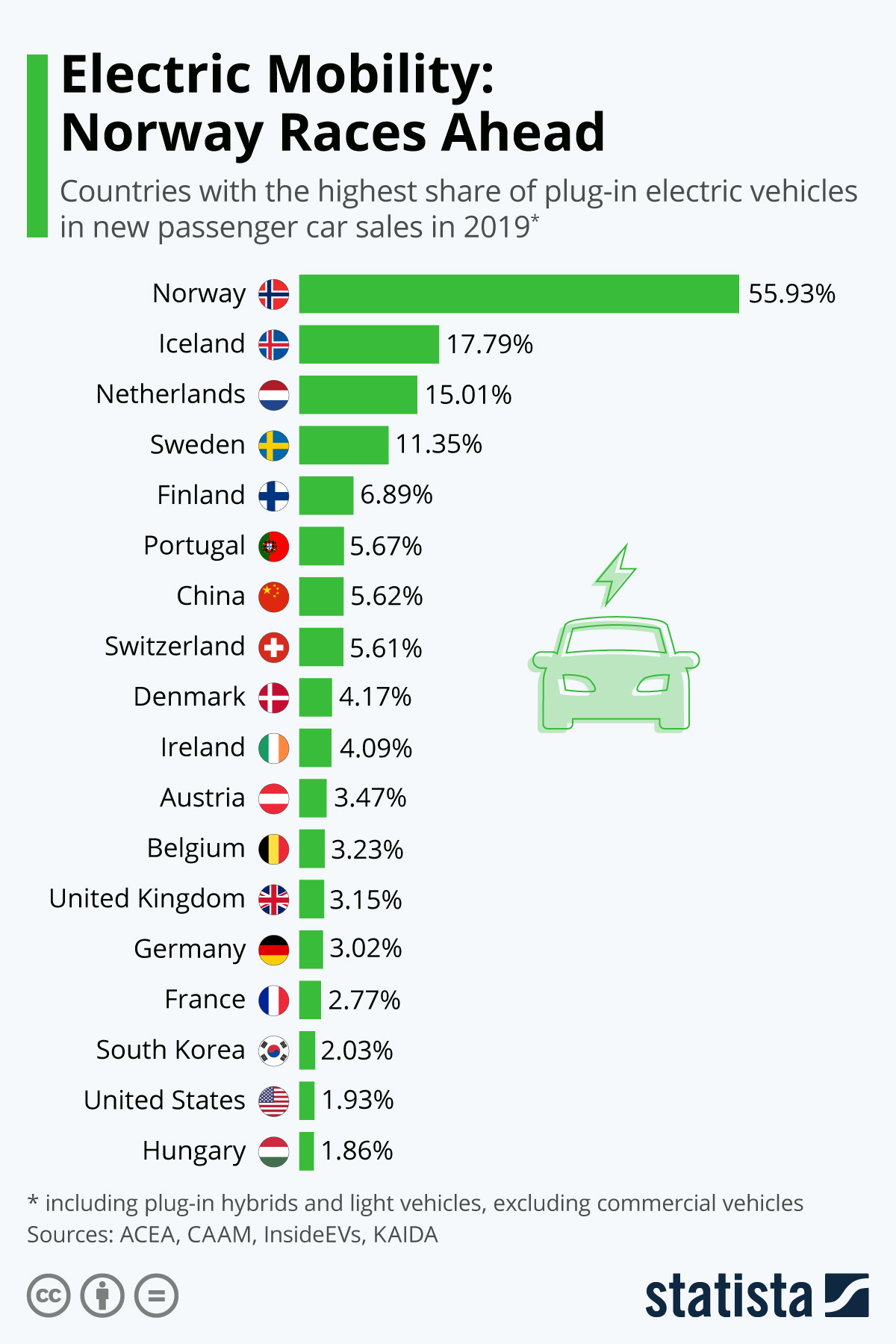

According to Statista, Norway’s EV sales was by far the highest in the world. The country has used its incredible oil wealth to fund its green transition. Others who came after Norway respectively are Iceland, Netherlands, Sweden, Finland, Portugal, China, Switzerland, Denmark, Ireland, Austria, Belgium, United Kingdom, Germany, France, Canada, South Korea, United States and Hungary. Although, electric vehicles are only a smart part of the vehicle market, its demand continues to grow.

Electric car use by country varies worldwide, as the adoption of plug-in electric vehicles is affected by consumer demand, market prices, availability of charging infrastructure, and government policies, such as purchase incentives and long-term regulatory signals (ZEV mandates, CO2 emissions regulations, fuel economy standards, and phase-out of internal combustion engine vehicles).

The global electric-vehicle (EV) industry is expanding rapidly. The regional output differs, with some EV markets reaching near-mainstream status, while others remain neutrally stuck. However, the Global EV sales are getting big enough to create substantial profit pools for well-positioned suppliers and other upstream players.

Key players in the EV market include Tesla, BMW Group, Nissan Motor Corporation, Toyota Motor Corporation, Volkswagen AG, General Motors, Daimler AG, Energica Motor Company S.p.A, BYD Company Motors, and Ford Motor Company account for a major electric vehicle market share.

As we can see, the market is clearly accelerating and adoption continues to rise for electric vehicles on a global scale. Lets hope this trend continues…

By Gary Bernstein