Some of the great business opportunities for Unified Communications as a Service (UCaaS) integrators and Value-Added Resellers (VARs) have been the emergence of cloud, telephony and Unified Communications (UC) technologies such as VoIP and virtual data center compute / storage. Others include the adoption of cloud operating systems such as OpenStack, enabling hyper scale-out of infrastructure. The cloud is enabling these services through its reduced cost and plentiful bandwidth of the public / private infrastructure. Integrators have historically earned their livelihoods from the re-sale of products and the professional services required to deploy solutions. Another source of revenue for these firms is acting as an Agent under a carrier for the interconnecting telecommunications links to provide connectivity to all of the clients’ equipment.

Because of the lengthy sales cycle and new client acquisition costs, the ability to sell incremental services to existing customers is critical for UCaaS integrators. However, while there are tremendous growth opportunities for the integrators to bundle cloud, equipment and professional services, there is also side to this part of the business that potentially leaves them exposed. This includes the tax consequences of bundling telecom services with equipment across multiple jurisdictions, and the even more complicated regulations governing compliance with the appropriate regulations when providing a telecom service.

The root of the problem is that UCaaS integrators are accustomed to a straightforward model of “sell / install the equipment, collect sales tax, move on”. The problems arise when interstate regulated communications services are thrown into the mix, triggering a slew of transaction taxes, excise, gross receipts, utility, 911, Federal Communications Commission (FCC), and State Utility Commission taxes. How does the typical UCaaS integrator remit, much less keep track of, all these taxes to remain in compliance?

The other major issue stems from the concept of “nexus”, or a business connection to a state that has the authority to tax. For example, you are selling equipment in one state and then selling similar equipment in another state, to another customer. You provide the second customer with a bundled communications service for them to conduct their business. Because of how regulations are structured, you have now created a nexus to that other state through the servicing of that second customer. Here’s where it causes the pain: not only are you going to be subject to tax in the second jurisdiction for the telecom services, but also for all the gear you sold them – when previously you just shipped to “an out-of-state customer”. Now, you have a tax liability from a state you didn’t realize you owed any money. Nexus for communications services, by extension, creates a nexus for any taxable good sold to the tax jurisdiction.

Remaining in regulatory compliance with multiple taxing jurisdictions if you are a growing SMB or enterprise company is highly complex. It is costly and time consuming to track all of the tax consequences of these activities, and represents a challenge for the typical UCaaS integrator who wants to sell these bundled services. Moreover, many of today’s billing systems are not attuned to these changing regulations and jurisdictions.

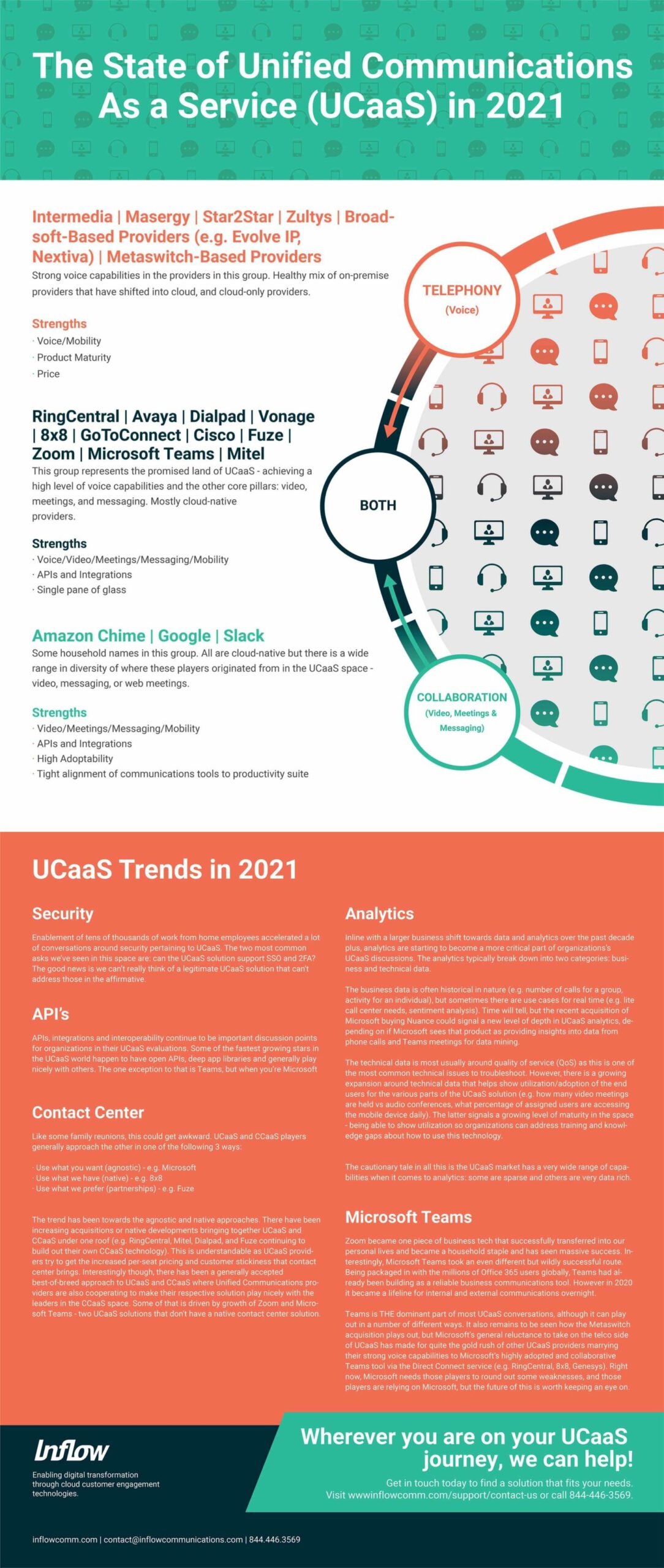

Infographic source: https://inflowcx.com/the-state-of-unified-communications-as-a-service-in-2021/

Those are the business problems that arise from the interstate sale and bundling of equipment and communications services. Now, let’s turn to the regulated communications services and equipment themselves:

A UCaaS integrator typically does not own its own IP network or ISP operation. It typically leaves the connectivity options up to clients or refers them to a carrier such as AT&T. In the case of providing a communications service, if the integrator is getting the client to outsource the infrastructure and services, a client will want to ensure that the network is secure, monitored, and doesn’t have to deal with Customer Premise Equipment (CPE) issues or firewall configurations. Whether it is Internet access or something that will securely connect multiple sites, such as MPLS VPN services, these are connectivity services that can be bought as managed services with limited interaction required on behalf of the client.

Secondly, clients recognize that the monitoring, upkeep, maintenance and configuration of VoIP systems, private cloud, hybrid cloud, etc., are also an operational and capital expense they would rather avoid. Therefore, a solution that provides managed services, bundled with connectivity options and, for example UC equipment, offers a powerful value proposition to help clients reduce CapEx and effectively manage their communications needs.

So, how do UCaaS integrators leverage telecom services and bundle the equipment in a way that helps avoid the interstate compliance and tax issues, while still generating a good margin on which to operate their business? What they need is an enabling service that combines all of the needs previously discussed, from compliance to functionality, while also allowing them to provide a services they would otherwise be unable to offer.

Currently, there are businesses that help integrators mitigate the risk of providing these services in the cloud. Partnered with telecom providers, equipment manufacturers and distributors, they help the integrator deliver regulated communications services for UC in the cloud, otherwise known as UCaaS. One example of a company in this space is TelAgility. Regulated communications services provided by the organization leverage new technologies and products, bundle them into a solution, and provide the support and enablement for VARs to become UCaaS integrators. This offer, which is managed with their own operations and billing capabilities, bundles services and product from companies such as Avaya, Westcon and AT&T. As a member of the AT&T Partner Exchange, TelAgility offers the latest technology in Managed Internet Services and MPLS VPN services to integrators to bring the most modern and innovative solutions to market. Another major benefit of this type of service for UCaaS integrators is quick time to market and existing regulations expertise as a 50-state interconnected VoIP provider, as well as support for billing back-end functions with integrators remaining as the face to the client.

In summary, the emergence of these bundled Service Providers, with expertise in the back-office systems to manage compliance, simplify the market entry for UCaaS integrators by functioning as the “telecommunications carrier of record” for the end customer. The service provider assumes all tax / regulatory compliance obligations. By using this kind of service, integrators can mitigate their risk in the cloud from a tax liability perspective, while also being able to provide their client base with a high value-added family of offers.

(Updated from 09/2019)

By Adam Cole