The corporate data center was long the defacto vehicle for all application deployment across an enterprise. Whether reporting to Real Estate, Finance or IT, this relationship served both data centers and their users well, as it allowed the organization to invest in specialized skills and facilities and provided the enterprise with reliable and trusted services.

The first major shift in this structure occurred with the success of Salesforce.com in the early 2000s, where Salesforce removed a significant hurdle for their key target, the VP of Sales, by providing the application “off premise”. VPs of Sales typically have no significant relationship with their IT organization, so this hosted offering allowed the VP to authorize the purchase fairly autonomously. Fast forward to today, and nearly all functions, from HR to Finance to ERP, are offered “as a Service”, further pressuring the corporate data center.

A recent report from Gartner estimated that today, 60% of workloads are running on-prem, and this percentage is expected to drop to 33% by 2021 and 20% by 2024. All major software companies, from Microsoft to IBM to Oracle, are focused on offering their software as a Service and in fact report on this growth as a key metric in their financials. Microsoft, in particular, noted “that by FY ’19 we’ll have two-thirds of commercial office in Office 365, and Exchange will be north of that, 70 percent.” Traditionally, these applications have represented some of the largest enterprise workloads, so the trend is unmistakable.

There are many reasons enterprise data centers will be required: location, security, financial considerations and regulatory requirements to name a few; certain organizations will continue to use them as strategic and differentiating assets. However, enterprise data centers will increasingly need to justify themselves against alternatives ranging from Applications-as-a-Service to Amazon Web Services to colocation providers like Digital Realty and Equinix.

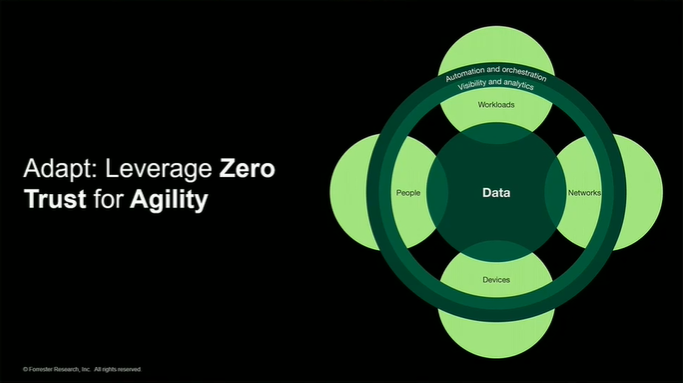

The market has accepted that most organizations will have a happy medium of hybrid facilities, a combination of on-prem and cloud or colocation options. A most important “point of inflection” occurs in this journey: The moment an organization extends their footprint beyond their in-house data centers, they immediately need to address a host of new issues; a few include:

The trend towards hybrid clouds is unmistakable, with commensurate benefits, but an organization must balance and justify this hybridization. One of the best examples of this consideration process come from the U.S. Federal Government in their Data Center Optimization Initiative (https://datacenters.cio.gov/). DCOI is a federal mandate that “requires agencies to develop and report on data center strategies to

Like numerous organizations, the U.S. Federal government has a cloud-first policy, but it has instituted a rigorous reporting and oversight process to prudently manage their data center footprint and computing strategy. Many other organizations, both in the public and private sector, should consider similar processes and transparency as they optimize their many hybrid cloud-computing options.

Existing enterprise data centers represent significant assets; how should their role in the overall cloud computing fabric be determined? Availability, cost and security will always be the dominant factors for any physical computing topology, with agility a recent addition. Define the key metrics and drivers, transparently and consistently, for the overall environment, and the best set of options will present themselves.

By Enzo Greco