Welcome to the future. It’s a beautiful Monday morning of 5th June, 2023.

Jane wants to buy her favorite tech stock trading at $100 per share.

Rather than logging into her regular brokerage account, Jane logs into blockchain-enabled fictional Cryptonomics Trade account.

Jane has her trade settled into her account in less than a second after submitting the order.

She spent mere pennies in transaction fees because there was no depository, no transfer agent, and no clearing corporation involved–all with unparalleled security while commanding the highest levels of trust.

Today, it can take up-to three days for stocks to change ownership as each transaction has to go through a three stage process of execution, clearing, and settlement.

Blockchain has better solutions for financial markets.

Blockchain technology is not only disrupting financial markets but it has potential to transform almost every aspect of our lives on this planet.

I am an attorney by profession and work closely with top executives in the most successful companies. Rapid changes in financial markets and the underlying technology infrastructure is the source of many sleepless nights. Without exception, each of my clients is actively working on integrating blockchain into their platform in some way. No vertical is immune to the blockchain revolution that is rolling through development clusters.

We are patent experts and we know that blockchain patent filings have exploded in line with the buzz around this brilliantly simple, but disruptive technology. A few years back, there were hundreds of filings, but now we have thousands staking some claim to the blockchain revolution. Top Fin Tech companies are spending billions in research so that they can secure future rights on technology that will be the backbone of the financial markets.

Stock markets haven’t changed much in the way they operate in the past 200 years with only incremental changes. New innovators will disrupt the capital markets in next few years.

Eric Ries, a San Francisco based entrepreneur and author of one of the best books on modern entrepreneurship The Lean Startup, is working on creating a new US stock exchange designed to disrupt the current stock markets.

He has the backing of LinkedIn co-founder Reid Hoffman, America Online co-founder Steve Case, PayPal founder Peter Thiel, legendary venture capitalist Marc Andreessen, and tech publisher Tim O’Reilly.

This is a sign that there is going to be a tectonic shift in stock markets.

Stock market is ripe for disruption and is going to be one of the blockchain’s strongest use cases.

This can primarily happen in two ways:

Stock markets use a centralized model where depositories, centralized transfer agents, and clearing organizations are responsible for settling trades and tracking ownership of shares.

The present system has issues like high equity transaction costs, operational overheads, delay in settlement of trades, and lack of transparency.

Exchanges can utilise blockchain for a decentralized settlement for transfer of shares.

There is no need for intermediaries i.e depositories, centralized transfer agents, and clearing organizations in a decentralized model which makes use of distributed ledger technology.

All your equity transactions can happen directly between investors, bringing down the costs, overheads, and the delays.

Perhaps, that is reason Nasdaq, one of America’s premier stock exchanges was testing the waters having launched a blockchain based private trading platform called Linq, allowing private companies that are not listed on a stock exchange to complete securities transactions.

Other top stock exchanges in the world such as ASX (Australian Stock Exchange) and India’s NSE (National Stock Exchange), are also looking at ways to leverage blockchain technology to overhaul their traditional mechanisms.

And new players such as Estonia-based Funderbeam are building new trading systems from scratch based on distributed ledgers.

So, let’s look in more detail on how blockchain is going to disrupt and streamline the stock market operations in the upcoming years.

Equity transactions done on blockchain powered securities platform are faster as trade confirmations are done through peers instead of any intermediaries.

Costs like trade verifications, settlements, and ownership records are significantly reduced with the elimination of intermediaries.

You don’t have to shell out $4.95 or $10 as commission for every trade as the only fees you will pay is the fee for using the blockchain network for transactions.

You no longer have to wait for many days to complete a trade and to receive/transfer the ownership, instead, settlements can be done in few minutes.

Goldman Sachs has estimated that by automating post trade settlements and clearing processes and other tasks, blockchain technology can save $2 billion in the U.S. alone and about $6 billion globally.

When exchanges run on blockchain technology, transactions of investors become transparent as data on completed trades are stored publicly and can be examined at any time by anyone connected to the network, bringing in the necessary transparency in the market.

Blockchain transactions also leave an immutable audit trail making all the transactions traceable. In other words it could become very difficult to cook the books, eliminating all kind of frauds.

In America, a pattern day trader (one who day trades four or more times in five business days) must maintain a minimum equity of $25,000 on any day that he trades. If the account falls below the $25,000 requirement, the pattern day trader will not be permitted to day trade until the account is restored to the $25,000 minimum equity level.

This rule is supposedly more of a protectionist measure but instead creates an entry barrier preventing people who have less than $25,000 from participating in the market.

This rule can be done away with in markets that are run on blockchain because of the built in protection mechanism in the network that takes care of any inefficiencies without creating a cost barrier. For Instance, real time settlement would help to reduce the counterparty risks and would free up collateral, creating increased capital efficiencies.

So if you have only $100 and want to trade you can do so, resulting in an increased market base as barriers to entry come down significantly.

One of the biggest advantages with blockchain is that it can enable a worldwide, peer to peer equity and debt marketplace. Intermediaries are removed, as issuers and investors or buyers and sellers connect directly.

And mobility of capital is maximized in a way that traditional wall street investment banks and brokerages simply cannot deliver.

It could be a slow process to replace traditional stock markets completely but eventually it will happen.

As of today, many blockchain based securities platforms are being built to lay the foundation for a whole new securities market that is an alternative to the existing stock markets. The one in which issuers and investors come together and transact with each other without the need for a regulator, stock exchange, transfer agents, and depositories.

Consider Overstock’s TZero for example, a distributed ledger platform for capital markets, where companies can raise capital and distribute & sell equities to investors in a secured environment.

According to Patrick Byrne, CEO of Overstock, the goal is to create an alternative to the NASDAQ with a ledger that is open and transparent.

Byrne, had stated that their platform has listed $80 to $120 billion in securities and registered 8000 investors since their launch. They charge between $1.99 and $2.99 per trade and settle the trades on the same day, lowering costs and saving time.

Equibit is another public blockchain based securities platform with no central authority that connects issuers and investors in a peer to peer network with settlement times of 10 minutes or less. The platform helps companies raise capital through equity or debt, making it possible for issuers of all sizes to access capital.

Similarly, their platform allows investors (retail & institutional) to trade in securities and participate in investment opportunities that have traditionally been open only to very rich investors.

For Instance, in the current stock market system of America, for you to invest in a company before it gets listed on the stock exchange, you need to have a networth greater than $1 million and an annual income greater than $200,000.

In such a scenario, how many people can even think of picking and investing in the next Uber or AirBnb?

But, platforms like Equibit allow small investors to invest in early stage companies.

With increased mainstream adoption, these blockchain based securities platforms can cater to companies like Spotify which are shying away from traditional IPO listings and are willing to distribute equity to investors through other mechanisms.

The original aim of bitcoin and blockchain was to be an alternative to the current financial system that is heavily reliant on central banks and other centralized third parties.

As of today, many startups and young companies depend upon venture capital to fund their growth to the point where they can list themselves on the stock exchange through an IPO. But, recent events indicate that these startups and companies may not require venture capital and stock exchanges for their capital needs.

Increasingly, capital is being raised through ICOs (Initial Coin Offerings) where investors receive cryptocurrency tokens in place of equities.

Think of ICOs as a means of raising capital comparable to an IPOs (Initial Public Offering) in the traditional capital markets.

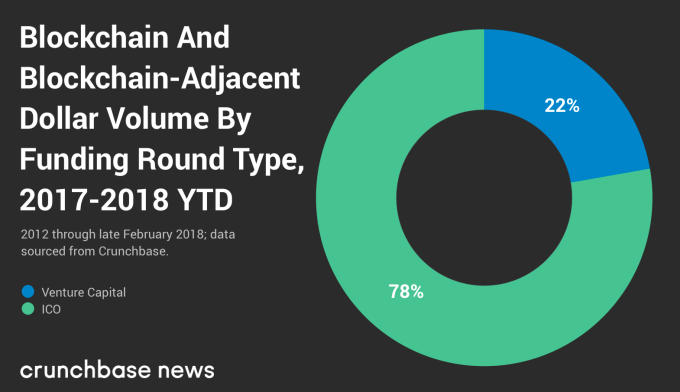

The chart below from TechCrunch shows the breakdown of capital raised between Venture Capital and ICOs

Image Source: TechCrunch

According to TechCrunch, since the beginning of 2017, blockchain and related startups have raised nearly $1.3 billion in traditional venture capital worldwide. However, nearly $4.5 billion was raised through ICOs.

Now look at the top ten highest ICOs in the market. Telegram has raised a mammoth $1.7 billion and other companies have also raised capital in hundreds of millions of dollars. In future, I wouldn’t be surprised if these figures increase further.

ICOs are displacing venture capital as well as capital markets as a way to raise capital. And raise how big!

Yes, there are questions and concerns about the genuinity of underlying businesses that launch these ICOs but that warrants a separate discussion altogether.

Point being, the success of good number of ICOs, if not all, does indicate about the things to come in the future, where ICOs pose a viable alternative to the traditional methods of raising funds – Venture capital and Stock Markets.

Today, technology is growing exponentially and is touching every aspects of our lives. Be it artificial intelligence, self driving, virtual reality, drones, 3D printing, and many more.

With every new such revolutionary technology that has the potential to disrupt, the question arises

‘What is the state of the existing regulatory laws governing such technology and what are its implications?’

That’s an important question given that the success or failure of these technologies could depend upon the way laws regulate them in the future.

And blockchain is no exception.

Blockchain when applied to stock markets has legal and regulatory challenges because of:

Given these challenges, governments around the world including US are grappling to understand blockchain’s possible impact on capital markets and the regulatory position is still evolving.

The U.S. Financial Industry Regulatory Authority (FINRA) issued a report entitled Distributed Ledger Technology: Implications of blockchain for the Securities Industry.

The report highlights the applications of blockchain technology that is being explored in the capital markets and discusses the potential impact this technology may have on the securities industry from implementation and regulatory perspective.

Things got even more interesting for startups and companies that are developing blockchain based technologies to take advantage of the huge market potential.

These companies may be at the cutting edge of blockchain innovation but are they aware of the looming legal and patent challenges for their innovations?

These are the questions that innovators need to ponder upon to shore up a competitive advantage early and to avoid legal hassles.

Take for instance the issue of intellectual property between a blockchain application developer and the end customer. In traditional software licensing agreements, the matters of intellectual property are clearly defined and agreed upon between the software developer and the end customer.

However, in case of blockchain applications, the matters of intellectual property are not yet clearly defined. If a customer shares his data in a blockchain network, can the application developer fully commercialize it including sharing the data with other parties?

Can the end customer restrict the use of his data by imposing an intellectual property ownership in the form of a licensing agreement on the application developer?

These issues can be tricky to deal with given the open source nature of the blockchain code and much of the blockchain technology itself being publicly disclosed a long ago.

In fact, the white paper on bitcoin and blockchain technology published by Satoshi Nakamoto restricts the patenting of the blockchain system. Although, new improvements and variations of technology can still be patented.

But any of this is not preventing people and companies from filing patents, primarily because they want to protect their innovations and use it as a bargaining chip in potential patent infringements.

After all, every company wants to dominate the market.

The number of entities applying for patents for technology that uses blockchain as an underlying framework has consistently grown over the years. Patents have been filed in the US alone by various companies like Bank of America, IBM, MasterCard, Coinbase, Accenture etc.

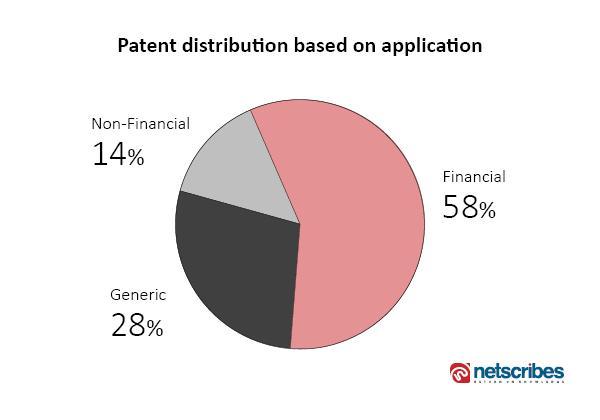

According to Netscribes research, this is how the blockchain patents are distributed across industries

As Netscribes research indicates the majority of the patent applications seem to come from the financial sector for now.

For instance, Mastercard, the world’s second-largest payments network filed a patent on a blockchain-based database capable of instantaneously processing payments, guaranteeing that merchants don’t need to wait days before receiving funds for their products.

As blockchain related patent applications filings continue at an increasing pace, startups and companies which are not early patent applicants will lose the first mover advantage that could cost them a lot in the future.

The best way to tackle these complex, legal, and intellectual property issues is to approach a legal consulting service early in the innovation process so that a robust strategy for protection of the company’s IP can be framed. The strategy that can earn a new patent on your blockchain innovation.

Companies and startups cannot afford to leave it late any more. As blockchain’s adoption goes more mainstream and as it transforms the way we exchange value, a company’s dominance will be determined not by who can innovate fastest but who can protect quicker.

By Thomas Franklin