Connected Vehicles

From cars to combines, the IoT market potential of connected vehicles is so expansive that it will even eclipse that of the mobile phone. Connected personal vehicles will be the final link in a fully connected IoT ecosystem. This is an incredibly important moment to capitalize on given how much time people spend in cars. When mobility services and autonomous cars begin to take hold, it will become even more critical as people will be behind a screen instead of behind the wheel.

Industrial equipment and mobility solutions may prove to be even larger and more lucrative than the consumer side. McKinsey & Company says that by 2025, IoT will have an economic impact up to $11 trillion a year, and that 70 percent of the revenue IoT creates will be generated from B2B businesses. In the connected vehicle world, industrial applications will likely follow this trend.

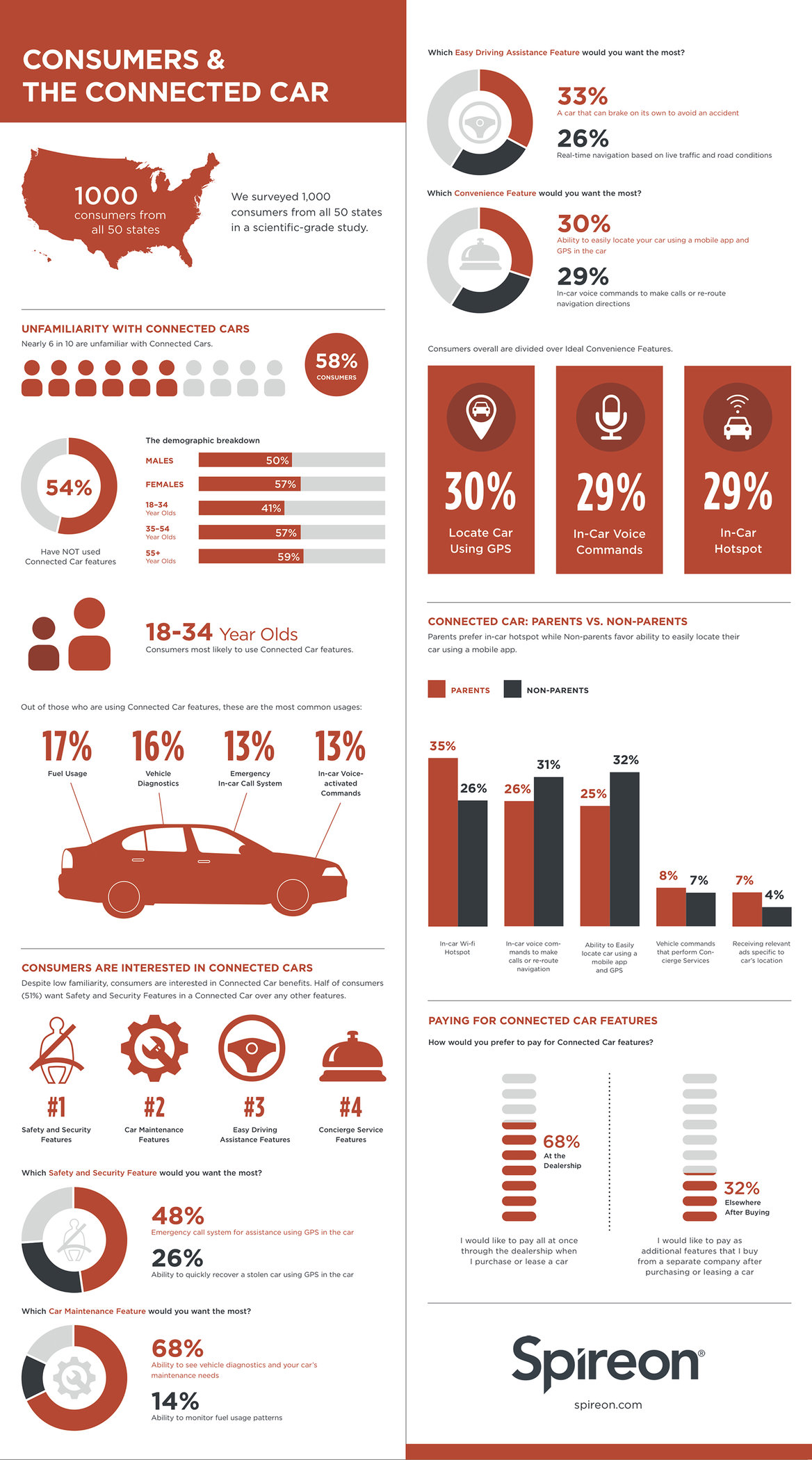

(Infographic source: Spireon)

Technologies like GPS, telematics services, on-board computers, specialized sensors, internet connectivity, and cloud-based data stream management are all fairly mature. The challenge businesses are facing now is how all this technology can be interconnected and used to monetize IoT services in connected vehicles.

To get started, here is a framework for understanding the connected vehicle space—from consumer to industrial offerings. I’ve outlined challenges and opportunities associated with the various business models and lessons learned from other markets to offer guidelines, best practices, and guardrails to maximize the chances for commercial success.

What are the offerings?

The number of individual connected car services that are available or coming to the marketplace is large, but we can place them in four basic categories:

- Transportation as a Service – Any alternative to traditional sale or lease of a vehicle that requires some amount of connectivity in order to work. Examples: peer-to-peer car sharing, multi-entity (group) leasing, and fleet subscriptions.

- Post-Sale/Lease Secondary Services – Services offered to vehicle owners/lessees after initial vehicle acquisition. Examples: entertainment delivery, driver experience personalization, roadside assistance, mapping and geo-fencing, human-assisted services like on-demand concierge parking, and intelligent preventive maintenance subscriptions.

- Road Use Measurement Services – Services directly based upon telematics-sourced data streams. Examples: usage-based insurance, road-use-based taxation, and commercial fleet tracking and management.

- Secondary Data Stream Monetization – The analysis of individual driving habits and patterns.

Examples: personalized discounted insurance promotions, or data for to third parties.

What should you do next?

Although these use cases appear to be vastly different from one another, there are some common themes and guidance which can be gleaned from them.

Here are next steps for any connected car industry player:

- Get your Data House in Order – The connected car depends on data streams produced by sensors and devices, but knowing everything about a person’s driving can be dangerous in malicious hands, so stringently secured systems and policies must be put into place. Some data is vehicle-specific and other data is individual-specific, and different data will need to go to different places, so companies need to deploy sophisticated data management systems that can handle an ever-shifting ‘many-to-many-to-many’ landscape of identity management. Savvy organizations will put systems in place at the outset in order to ‘future-proof’ themselves and lay the groundwork for market agility and consumer safety.

- Embrace Your Data – If you have access to data, even when it has no apparent direct influence on how you choose to charge for your offering, retain it anyway. Insights are always available via analysis of the consumption patterns of users, but only if you keep the data in an organized, centralized, accessible place. Knowing how users consume a service allows you to stay nimble in a market that is guaranteed to constantly shift and change.

- The Money Isn’t in the ‘Thing’ – In the IoT world in general, many businesses realize too late that the true monetization opportunity lies NOT with the physical ‘thing’ itself, but rather with the virtual perpetual service that it unlocks. Companies like Jawbone, GoPro, and FitBit all learned this the hard way. Recurring, perpetual services provide an ongoing linkage to a customer that cannot be achieved via any one-and-done sales model, and build an annuity for the enterprise that keeps on giving and doesn’t require constant reinvestment in costly customer acquisition.

- Learn to ‘Count the Beans’ Differently – Connected vehicle services, like any IoT-based services, lend themselves readily to recurring revenue business models which are measure by fundamentally different KPIs than the one-time-sale model. Profit margins in recurring revenue models are often not fully realized at point of sale, but with a ‘long tail’ of annuity-style profit once margin has been reached. The lessons learned by OEMs years ago when many also became direct lenders are the best analog for recurring revenue success available to them. OEMs should consider housing their connected car strategies within their lending arms for this reason.

- Take Engineers Out of the Equation Where You Can – Agility and speed to market are of paramount importance in the connected car world. Organizations that show a willingness and ability to get to market quickly, even if imperfectly, and to aggressively pursue multiple simultaneous monetization strategies knowing that not all will succeed—these will be the organizations that ‘win’ in the connected car space.

- Prepare Back-Office Systems – Unfortunately, especially for mature enterprises like OEMs that have developed dependencies on legacy back-office systems, existing infrastructure was not built to rapidly support new offering models like recurring revenue. More modern (usually cloud-based) back-office systems offer not only dramatically shorter implementation timelines than legacy or home-grown systems, but also put the power of innovation and change in the hands of business users rather than engineers.

The Clearest True North—Connected Vehicles

The obsession with the cult of cars is understandable, but the truth is that there are many segments of “IoT on Wheels” that are moving quickly towards full-on connectedness.

Like many subsets of the IoT (e.g. wearables, connected home) consumer applications for connected personal vehicles get all the hype, but the business applications are really demonstrating the most traction.

Whether B2B or B2C, there is no magic formula for exactly how to make money in the connected vehicle space, however, we are sure to see fascinating changes occurring in the transportation landscape in the coming years. There is hardly anything as captivating, and potentially profitable, as the emergence of IoT on wheels.

Stay tuned for Part 2 of the series next month…

By Tom Dibble

![]()