CEOs, investors, analysts, and business advisors have fallen in love with the recurring revenue business model. In fact, when comparing like software companies, Wall Street gives 2x higher valuations for businesses with successful recurring revenue models in place. It’s no wonder that research indicates 50% of US businesses have already adopted or are considering to adopt a recurring revenue business model.

And why not? Recurring revenue is more predictable than one‐time sales.

Global 5,000 public companies are quickly moving to transform via recurring revenue models. Here’s why: suppose you run a $100 million company and 90 percent of that is recurring revenue. When the next year starts, you can count on $90 million in repeat revenue and only need to book $10 million in new sales to reach last year’s level. If you run a $100 million non‐recurring revenue business, you start at zero every year and need to book the entire $100 million each time.

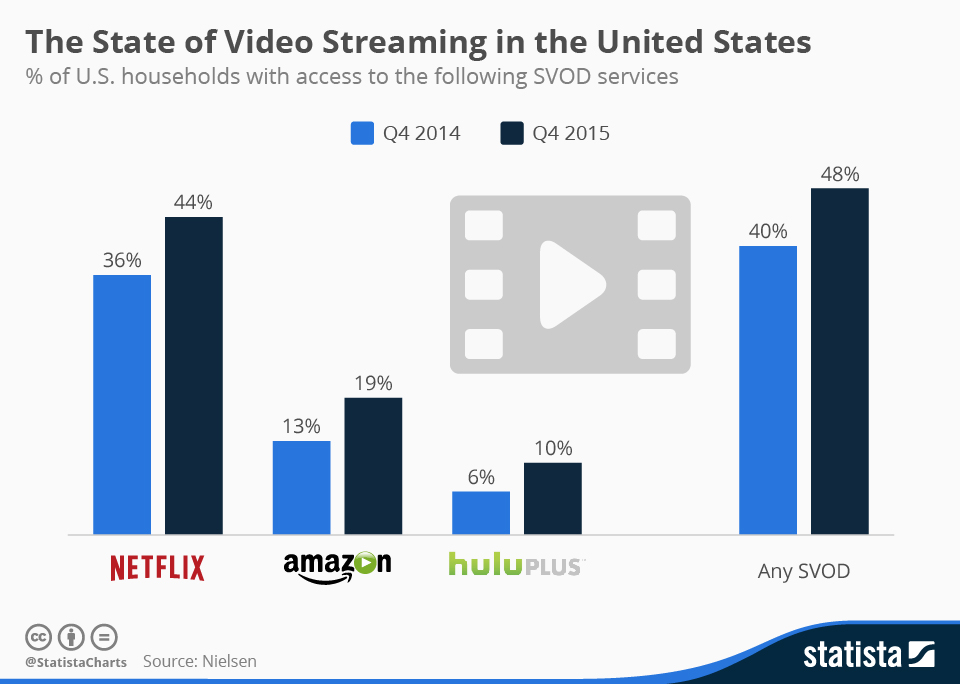

Significant competitive advantages exist with recurring revenue models that can adjust to meet changing market demands. Compare the fates of two movie rental companies: subscription‐based goliath Netflix and once‐mighty Blockbuster, a company that relied on one‐time transactions.

(Image Source: Statista)

As customer demands and preferences shifted towards new technological advancements, Netflix soared and Blockbuster headed for bankruptcy. Customers clearly preferred the convenience of Netflix’s distribution methods and the cost advantages of a recurring revenue model, which enabled the company to develop a rapidly expanding and predictable business.

Recurring revenue models offer advantages that go beyond predictable streams:

Yet, with the added flexibility and increased benefits of recurring revenue models also comes added complexity that can trickle down into every aspect of managing customers and products. Keep in mind that while the model is compelling, failing to manage its hidden complexities can negate the benefits.

Many mistakenly view recurring revenue as just basic subscription billing, like paying for a time-honored magazine subscription. But recurring revenues come in many flavors: basic subscriptions, usage-based, tiered, and hybrid models to name a few. As a result, recurring revenue management may be one of the most misunderstood concepts in the business world. Many managers think of recurring revenue management as repeat customer orders handled by the billing department, with printers spewing out invoice after invoice, while the accounts receivables manager sends out an occasional collection email. If it were only that simple.

Smart businesses, on the other hand, realize that taking advantage of recurring revenue setups require technology that not only handles the bill, but also monetizes their products and services over time.

Bill handling is just the start. To maximize recurring revenue, companies need to manage the complete customer relationship rather than the discrete transaction. The goal is to engage with the customer over the course of years or even decades. To effectively manage the relationship you must manage every customer interaction or “revenue moment”. Since every interaction has the potential to add profits or lose customers, management is critical.

The good news is recurring revenue businesses have ample opportunities to manage these moments. Here are some revenue moments that should be managed and accompanying actions that could be taken:

By focusing on the relationship versus the transaction, you can proactively guide a positive customer experience into a loyal, long-term partnership.

When embarking on a recurring revenue model, you should rethink how you currently price, package, and manage revenue. To build a successful recurring revenue management system, “normal” communications and billing systems must also change. What’s traditionally relegated to back office operations should move into the front office, driven by the focus on the customer relationship.

Hop aboard. The recurring revenue implementation journey may be windy, but the end destination is worth its weight in gold.

By Tom Dibble