It looks like securing funding from AI startup accelerators is a child’s play these days. Artificial intelligence is buzzword of the day among angel investors, VC funds, and journalists alike. Finding funds and resources for developing AI projects may be easier than ever before, but what is the right type of funding for a promising startup. What viable alternatives an AI startup has? Is it at all worth allowing external shareholders entering your AI startup?

If you are not bootstrapping, you can get early stage funding by all kinds of institutions that invest in startups: angel investors, incubators, or accelerators. You can also opt for a hybrid funding method. Let’s start with taking a look at selected accelerators and incubators that provide support for AI startups.

Alexa Accelerator: A startup accelerator created by the Alexa Fund and built around the belief that voice will fundamentally improve the way we interact with technology. The companies chosen are taking part in a 13-week program in Seattle to work with technologists and product leaders from Amazon and Techstars. Startups receive $100.000 of funding upon acceptance in convertible notes, as well as $20,000 in exchange for 6% of equity. An ‘Equity Back Guarantee’ clause gives the founders chance to lower up to zero Techstars’ equity position within three days from the end of the program).

Bosch DNA: They target startups in areas such as deep learning, AI and machine learning. The program lasts for 18 week. Startups that have already received funding can apply.

Comet Labs: They started as a fund focused on investing in AI startups, but moved to provide a whole assortment of other common needs and challenges with building businesses. The program partners with established industry brands to give startups access to vital resources and knowledge that otherwise would be out of reach. Investment is provided on a case-by-case basis and under the form of a warrant, a convertible note, or a discounted equity investment.

Creative Destruction Lab: They support entrepreneurs with an MVP with mentorship on how to raise a round, develop the go-to-market strategy and deal with legal, accounting, and other business processes. It is a seed-stage program for massively scalable, science-based companies. The program employs an objectives-based mentoring process with the goal of maximizing equity-value creation.

CyberLaunch: A 90-day accelerator program that provides $20-100,000, depending on the stage of the venture, and makes direct introductions to investors. Additional $100,000+ of benefits, including deferred legal services, co-working space, and AWS credits. They have over 100 mentors.

Deep Science Ventures: They are venture builder for scientists and engineers at any stage of their career. When the company hits the DSV investment criteria, we invest £50,000 for a 10% equity stake. Follow up investment of additional £50k convertible note is available for the most promising teams.

Eonify: They assist startups interested in health projects and themselves design and develop senior health and wellness personal AI assistant using advanced JPL/NASA technology.

Founders Factory: They co-create or develop a few AI businesses within their acceleration program every year. They offer £30,000 cash and £220,000 in services including desk space in their Kensington hub and access to exclusive events and team. An intense 6-month program is tailored and managed against each startup’s growth objectives.

H2 Ventures: They invest $100,000 ($50,000 cash) into AI startups with founding team no larger than four people in return for a minority 10% equity share. Their 6-months accelerator program requires relocation to Sydney for the duration of the program.

IBM Alphazone: This 20-week program helps startups building leading solutions for the enterprise market. The program focuses on post Seed & Round A funded companies with aim to create long-term technology and business partnership with IBM worldwide. Three startups will get a grant of up to $25,000 and access to Becton, Dickinson and Co.’s subject matter experts and Guidepoint’s key opinion leader network. cloud services credit of up to 0,000 per year is provided.

Innovat8 Connect: Direct collaboration with Singtel and up to $75,000 in funding for startups to test and validate their solution. Singtel Group also provides commercialisation through access to their customer base.

Kapsch Factory1: The program allows seven program participants, lasts for 6 months and provides equity-free accelerator participation. It aims at building joint proof-of-concept projects as a foundation for long-term strategic relationships.

Merantix: They form joint venture partnerships in which they serve as an artificial intelligence laboratory and venture builder. Four areas of interest are finance, healthcare, advertising and automotive.

Microsoft Accelerator: They have dozens of AI startups in their portfolio. Eligible startups are also able to scale their business with up to $120,000 of Azure cloud services per year.

NextAI: Initial funding of CAD 50,000 which can be increased by CAD 30,000 while top performing teams can get CAD 150,000 of additional funding.

Nvidia Inception: Benefits for startups include consideration for the GPU Ventures Program worth $500,000 – $5,000,000 as well as assistance in the field of sales & marketing, joint development, and product distribution.

Play Labs: A new accelerator, apparently for MIT-affiliated startups. MIT-affiliated startups will get an initial investment of $20,000, hands-on mentoring, a curriculum of speakers and advisors designed to help them make their startups successful, introductions to industry experts. Follow-on investment up to an additional $80,000 after graduating from the incubator is available as part of their seed round.

Rockstart AI Accelerator: Rockstart provides €20,000 cash and €80,000 of in-kind funding, office space in Den Bosch for the duration of the program, and support from mentors from relevant industries, as well as more than 50 benefits and deals worth about €600,000. One of the lead investors their program has committed to invest at least €200,000 in an AI startup of their choosing after the Demo Day. They ask for 6% of equity from startups but only after they have managed to raise a further round of funding.

Startup Garage (Facebook): Their program is open to early stage (seed) and scaling (post Series A) companies with a live service currently available. They offer free access to brand new offices, access to the biggest French startup community and network at Station F, collaboration with similar startups, mentorship and dedicated training from Facebook experts, access to Fb Start partners as well as access to Facebook tools and products.

TechCode Global AI+: Ten out of fifty startups they select for the program will get an initial investment of $50,000. Their accelerator is especially valuable for startups that have product-market fit, some traction in the US and are looking for a streamlined way to scale globally and into China. Incubator services include highly-subsidized office space and low-touch assistance that startups need to build, sell and scale their products.

The Hive: They co-create AI startups providing seed funding of $1.5 million to $2 million. They provide assistance for future rounds of funding and connect you to VC investors. Assistance for building an ecosystem of early customers is available.

Y Combinator: They would fund an AI startup in every vertical. Their standard funding is worth $120,000 in return for 7% of the company’s equity.

Zeroth AI: They invest $120,000 in exchange for 9-10% equity, which comes as a combination of $20,000 in exchange for 6% common stock plus $100,000 SAFE convertible note.

This is the easy path to fund your AI startup and you should bear in mind that with the exception of Kapsch Factory1 all other accelerator and incubator programs ask for an equity stake. Do you really need to give up an equity stake in a promising AI company?

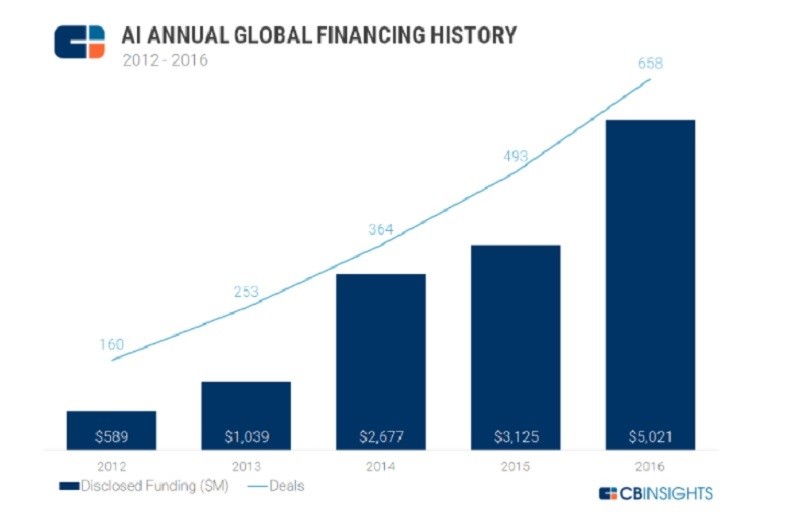

Roughly 550 startups whose core activity is artificial intelligence attracted over $5 billion in venture capital funding in 2016, a report by CB Insights reads. It appears that AI startups will receive the lion’s share of VC funding in the next years judging by the rate of growth of VC financing in this tech industry segment. During the time of 2012 to 2016, the number of deals rose from 160 to 658 a year while funding hit a record high of $5.02 billion last year as compared to just $589 million in 2012.

(Image Source: CB Insights)

The chance is good that if you are an AI startup backed by an accelerator or incubator, you are looking for VC funding and eventual IPO as well. VC investors are more than willing to pour their money into promising AI and Machine Learning companies and there are funds specializing even in backing startups that already enjoy growing customer base and have firmly set their foot in the market.

It also appears that AI-focused venture capital investors have higher risk tolerance compared to other VC funds which are already more selective when investing in tech startups. Nonetheless, every large company seems to have set aside funds to invest in AI – from Toyota to Google to Salesforce among many others. On the other hand, the most active VC investors are not exactly funds set up by large corporations but VC vehicles that specialize in innovative tech. Facebook and Microsoft, for example are not on the list of the most active investors in AI through their respective VC funds.

|

Rank |

Investor |

|

1 |

Data Collective |

|

2 |

Intel Capital |

|

3 |

Khosla Ventures |

|

4 |

New Enterprise Associates |

|

5 |

Google Ventures |

|

6 |

Andreessen Horowitz |

|

7 |

Accel Partners |

|

8 |

SV Angel |

|

9 |

Plug and Play Ventures |

|

10 |

Slack Fund |

|

11 |

Horizons Ventures |

|

12 |

General Catalyst Partners |

|

13 |

Norwest Venture Partners |

|

14 |

Bessemer Venture Partners |

|

15 |

First Round Capital |

|

16 |

500 Startups |

|

17 |

Bloomberg Beta |

|

18 |

FundersClub |

(Source: CB Insights)

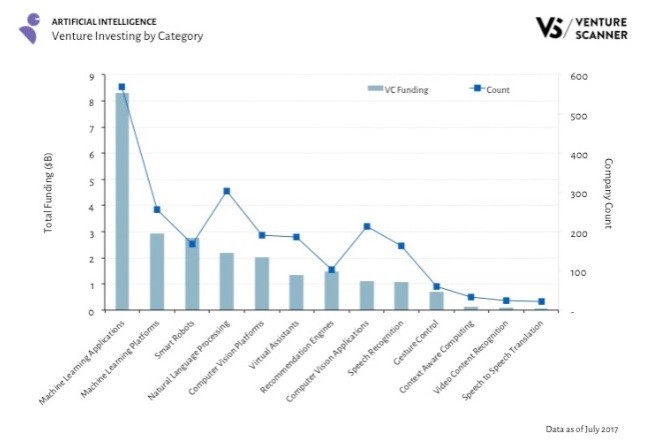

Machine learning technologies, smart robots, natural language processing, and computer vision platforms attract most of the total VC funding for companies working in the AI field. Other promising technologies in which VC funds are investing include recommendation engines, virtual assistants, computer vision apps, speech recognition, and gesture control. Categories such as context aware computing, video content recognition, and speech-to-speech translation get the smallest portion of investments.

(Image Source: Venture Scanner)

Let’s return to the most active VC investors in AI.

As we’ve discussed, these are some of most active VC investors in AI at the moment. However, many other VC funds are eager to invest in your AI startup whether at an early stage or as growth funding.

The last article of this AI funding series will discuss whether you really need VC or accelerator backing to nurture an AI startup. Bootstrapping is a viable option especially when complemented by some underrated resources that can help you grow your startup.

By Kiril V. Kirilov