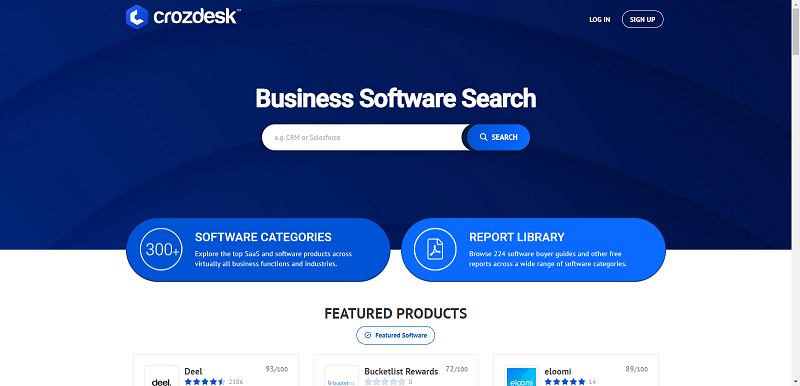

Exploring SaaS Directories: The Path to Optimal Software Selection

Exploring the Landscape of SaaS Directories SaaS directories are vital in today’s digital age, serving as key resources for businesses seeking informed software selections. These platforms offer extensive reviews, enabling [...]