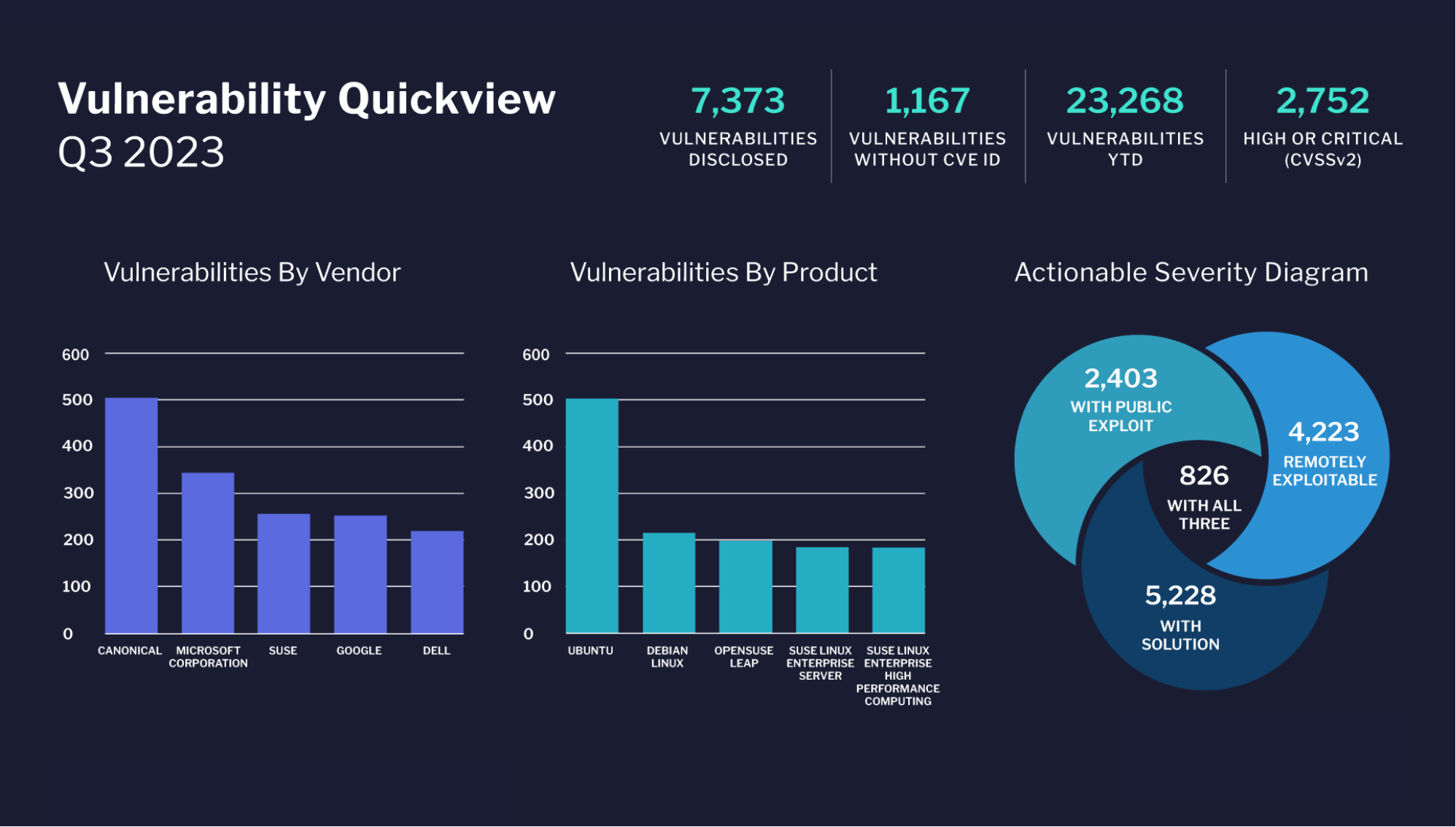

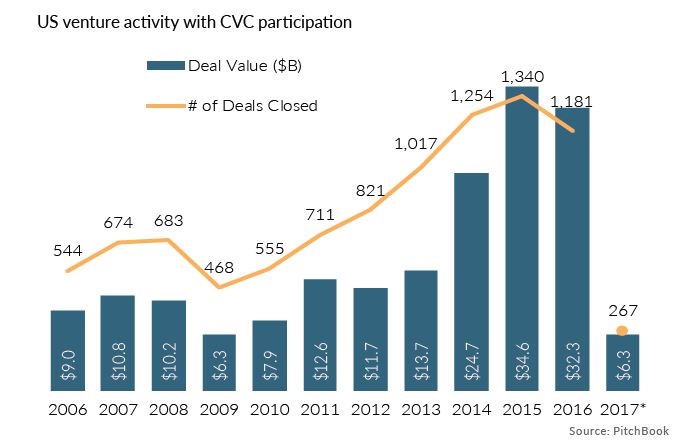

US venture capital investment is returning to normality. A National Venture Capital Association and PitchBook Data report shows that innovative startups are finding it harder to get funded than they did during a spike over the past couple of years. NVCA analysts believe 2017 corporate venture capital funding will revert to its levels of five years ago. This in fact represents a step towards sustainable funding.

Venture capitalists are strengthening existing portfolios and looking for more quality in startups. Founders are having to revert to sheer performance instead of relying on novelty for its own sake. Amid a stable public market, however, initial public offerings offer a sound financing alternative to tech startups.

After growing steadily in 2015, corporate VC has fallen noticeably. The first quarter of 2017 saw 267 corporate venture capital deals. Late stage CVC funding rose slightly on the prior quarter. Median CVC deal size and valuation are close to decade highs.

US corporations appear wary of a slowdown in innovative technology startups. The Slack for Instance. Their CVC fund is backed by Slack’s market valuation of $4 billion and prominent investors like Andreessen Horowitz, Social Capital, and KPCB. Now, Slack invests in startups who are demonstrably intent on developing market share and product range building upon Slack’s core product and service. This approach exemplifies CVC’s wish to fund and integrate technologies they have acquired. It is this which informs their due diligence.

The size of median round deals in which CVCs are stakeholders still outpaces that of non CVC deals. Software is most attractive for CVCs. It attracted half of all deal value in Q1. Most funding, 74 percent, went to deals sized $25 million and above.

Exit activity has declined for fourth consecutive and six of the past eight quarters. Its value since January is $14.9 billion. This signals that 2017 could be a record year for exits. More notable 2017 exits include Snap’s $3 billion initial public offering and Cisco’s $3.7 billion acquisition of AppDynamics. Software companies got 62 percent of first quarter exit value.

Another first quarter trend is towards more dynamic IPO business. VCs saw 15 companies backed by them filing or completing IPOs. Snap aside, investors welcomed MuleSoft raising $221 million at a $2 billion valuation, and Okta seeking a valuation of some $1.2 billion and some $150 million of funding. Six companies valued over $1 billion transacted diverse IPO business in the quarter.

Public investors are finding their feet after US Presidential election uncertainties. They are enjoying record S&P 500 highs and a strong dollar. Factors like these fuel rejuvenated IPO activity. The year is set to outpace 2016, marked by political reservations.

The booming private market is prompting tech companies to file for IPOs instead of seeking strategic buyers. When markets rise, the number of potential buyers falls; 2017 will most likely see fewer mergers and acquisitions for VC backed tech companies.

The mean time to exit for VC backed companies is lengthening. These companies raise funds at higher valuations compared to other startups. They can afford to decline acquisition offers. Okta, for instance, rejected a $1 billion acquisition and is seeking higher valuation through an IPO.

The market does not lack potential buyers, but the year should not witness many VC backed mergers and acquisitions. Companies appear minded to focus on integrating acquisitions. In the past three years, VC backed M&A deals hit a record $152 billion. But in 2017 more and more technology startups will explore public listing options.

By Kiril V. Kirilov